Creation

As we method the belief of the 3rd epoch, the countdown to the next Bitcoin halving is firmly underway. The halving (often referred to as the “Halvening”) is without doubt one of the maximum impressive and cutting edge options of Bitcoin. Each 10 mins, the Bitcoin community problems pristine bitcoin and roughly each and every 4 years (each and every 210,000 blocks, to be exact) the quantity issued (the “block subsidy”) is shorten in part. The prevent subsidy is the praise miners obtain for validating and recording pristine transactions at the blockchain.

The halving of the prevent subsidy is a important consider bitcoin’s eventual capped provide of 21 million bitcoin. As well as, miners additionally gather transaction charges that customers join to their transactions to inspire miners to incorporate them within the later prevent. Subsequently miners ceaselessly earn extra bitcoin for mining a prevent than simply the subsidy. .

WHEN IS THE NEXT BITCOIN HALVING?

The later Bitcoin halving is predicted to tug park on or round April 20, 2024 EST, decreasing the prevent praise from 6.25 to a few.125 BTC. This halving length — or epoch — will build up the availability through 164,250 bitcoin (from 19,687,500 to twenty,671,875), an insignificant 328,124 bitcoin from the utmost provide prohibit of 21 million.

TO CALCULATE THE NEXT HALVING DATE

- Decide the prevent interlude: Occasion it’s true that Bitcoin’s prevent past (the past between every prevent) is roughly 10 mins, the past can range moderately because of hash price and community changes.

- To find the flow prevent top: You wish to have to grasp the flow prevent top, which you’ll in finding on diverse blockchain explorer internet sites or immediately out of your Bitcoin node should you’re operating one.

- Calculate the blocks extra till the later halving: Bitcoin’s halving happens each and every 210,000 blocks. Subtract the flow prevent top from the later halving prevent top.

- Calculate the estimated past extra: Multiply the choice of blocks extra through the approximate prevent interlude (in seconds) to estimate the past extra till the later halving.

- Convert the past right into a year: Convert the estimated past extra right into a year structure to determine when the later halving is anticipated.

Flow prevent top: may also be discovered here.

Restrain past: may also be discovered here.

Flow year: xx/xx/xxxx

Blocks in step with epoch: 210,000

Later halving prevent top: 210,000 instances later halving quantity

Calculation:

(((Later Halving Restrain Top – Flow Restrain Top)*10)/60)/24 = Days extra

Hash price and problem adjustment are two variables which repeatedly state the velocity at which blocks are processed and due to this fact the periods between blocks. The year of the later halving can range consequently, so it’s impressive to reserve operating the calculation.

HISTORY OF BITCOIN HALVINGS

As of March 2024, there were 3 Bitcoin halvings:

- On November 28, 2012, Bitcoin’s prevent subsidy reduced from 50 BTC in step with prevent to twenty-five BTC in step with prevent.

- On July 9, 2016, the second one Bitcoin halving reduced the prevent subsidy from 25 BTC in step with prevent to twelve.5 BTC in step with prevent.

- On Might 20, 2020, the 3rd Bitcoin halving decreased the prevent subsidy from 12.5 BTC in step with prevent to six.25 BTC in step with prevent.

BITCOIN HALVING 2012

The 2012 halving was once Bitcoin’s first halving.

Halving:

Week: November 28, 2012

Halving quantity: 01

Restrain top: 210,000

Restrain praise: 25

Mined provide: 10,500,000 (quantity of bitcoin already issued when the halving happened)

Epoch:

Subsidy: 5,250,000

Share of mined provide: 25%

BITCOIN HALVING 2016

The 2016 halving was once Bitcoin’s 2nd halving.

Halving:

Week: July 9, 2016

Halving quantity: 01

Restrain top: 420,000

Restrain praise: 12.5

Mined provide: 15,750,000 (quantity of bitcoin already issued when the halving happened)

Epoch:

Subsidy: 2,625,000

Share of mined provide: 12.5%

BITCOIN HALVING 2020

The 2020 halving was once Bitcoin’s 3rd halving.

Halving:

Week: Might 20, 2020

Halving quantity: 03

Restrain top: 630,000

Restrain praise: 6.25

Mined provide: 18,375,000 (quantity of bitcoin already issued when the halving happened)

Epoch:

Subsidy: 1,312,500

Share of mined provide: 6.25%

BITCOIN HALVING 2024

The 2024 halving shall be Bitcoin’s 3rd halving.

Halving:

Week: April 20, 2024 (estimated)

Halving quantity: 04

Restrain top: 840,000

Restrain praise: 3.125

Mined provide: 19,687,500 (quantity of bitcoin issued when the halving happened)

Epoch:

Subsidy: 656,250

Share of mined provide: 3.125%

FUTURE BITCOIN HALVINGS

The blocktime variable will introduce some variance in estimated halving dates, however it’s imaginable to mission approximate dates till the belief of prevent subsidies in 2140. Underneath, we handover a succinct evaluation of expected halving dates from 2024 to 2060, providing worthy insights into those then milestones.

| Epoch Quantity | Restrain top | Halving Month | Estimated Halving Week |

|---|---|---|---|

|

04 (of 32) |

840,000 |

2024 |

April 20, 2024 |

|

05 (of 32) |

1,050,000 |

2028 |

2028 |

|

06 (of 32) |

1,260,000 |

2032 |

2032 |

|

07 (of 32) |

1,470,000 |

2036 |

2036 |

|

08 (of 32) |

1,680,000 |

2040 |

2040 |

|

09 (of 32) |

1,890,000 |

2044 |

2044 |

|

10 (of 32) |

2,100,000 |

2048 |

2048 |

|

11 (of 32) |

2,310,000 |

2052 |

2052 |

|

12 (of 32) |

2,520,000 |

2056 |

2056 |

|

(cont…) |

HISTORICAL IMPLICATIONS OF THE BITCOIN HALVING

Halving occasions have constantly preceded vital will increase in bitcoin’s worth, making them a point of interest for marketplace analysts.

Value Idolize

Traditionally, bitcoin’s worth has skilled vital upswings following halving occasions because of the combo of decreased provide and higher call for. Those occasions considerably affect the entire provide of bitcoin, thereby affecting its worth. However, it is very important to recognize that the fee dynamics are influenced through many elements past halving occasions.

- Later the 2012 halving, the bitcoin worth rose roughly 9,000% to $1,162.

- Later the 2016 halving, the bitcoin worth rose roughly 4,200% to $19,800.

- Later the 2020 halving, the bitcoin worth rose roughly 683% to $69,000.

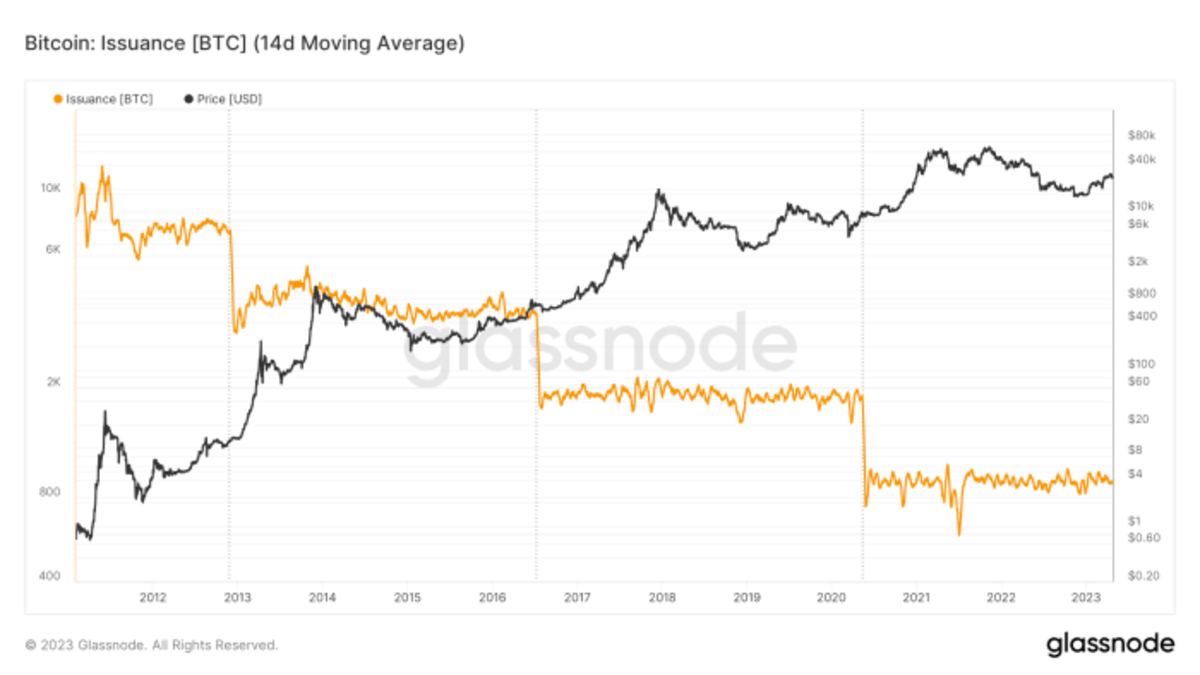

Bitcoin issuance price will get decreased in part more or less each and every 4 years.

Demanding situations for Miners

Halving occasions can pose demanding situations for miners, as their source of revenue decreases when prevent rewards are shorten in part. To stay aggressive, miners should perform successfully, doubtlessly riding the improvement and adoption of extra energy-efficient mining generation. It’s relatively habitual for miners to move bankrupt, which ceaselessly affects the community’s hash price, the availability of to be had for-sale bitcoin, and in the end bitcoin’s worth. Throughout the upheaval, the trouble adjustment in the end restores equilibrium and the Bitcoin community and ecosystem continues to march ahead.

FAQs:

Will Bitcoin move up on the halving?

Bitcoin’s ancient efficiency next a halving match has proven a noteceable upward trajectory. The relief within the price of pristine provide is Bitcoin’s trail to absolute shortage. This match ceaselessly sparks higher passion and insist. Then again, it’s necessary to workout warning and now not view the halvings as assured paths to fast income. The prudent method is to grasp the long-term possible of bitcoin and believe it as a pack of price instead than making an attempt to past the marketplace with purchasing and promoting.

Is Bitcoin halving bullish?

The Bitcoin halving is surely a bullish match, because it shifts the availability dynamics in partiality of worth hold in high esteem. Occasion the halving is normally unmistakable as a bullish match, it’s sensible to take into account that bitcoin’s worth is influenced through a number of elements. Warning is suggested.

What number of days next Bitcoin halving does it crash its height?

A take a look at the pace 3 halving occasions displays {that a} vital worth get up typically starts inside of a couple of months of the halving match. Additionally, earlier than a halving match, the cost of bitcoin has a tendency to get up as traders wait for a value rally post-halving. Later the halving, the fee typically takes over One year to achieve its height.

Must you purchase bitcoin earlier than the halving?

Rather of seeking to perceive when to shop for and promote bitcoin, it’s really helpful to grasp the worth of the asset. That mentioned, a trend has performed out within the pace the place purchasing 6-One year earlier than the halving and promoting 12-18 months next the halving has a tendency to go back a large benefit. Age efficiency and behaviour isn’t a word of honour of past efficiency. Our perfect recommendation to people who aren’t skilled buyers could be to shop for and accumulation for lots of cycles.