Africa stands on the cusp of a monetary revolution as Ecowas region financial ministers and central bank governors advanced plans to launch the single currency initiative, known as the ECO. The Financial Public of West African States (ECOWAS) guarantees to reshape the commercial ground of 15 international locations with the advent of ECO. Amidst the thrill of this unified foreign money, a virtual contender—Bitcoin—emerges from the shadows, providing extraordinary answers to the continent’s remittance woes. May Bitcoin keep the important thing to a extra inclusive, cost-effective, and resilient monetary time for Africa? No longer even a query over right here, however an enjoy. Because the ECO foreign money initiative progresses, Bitcoin emerges as a compelling supplementary, providing distinctive answers to longstanding monetary demanding situations in Africa.

Exploring some factual narratives, In a statement by Mr Wale Edun ( Nigeria’s Finance minister ) and his colleagues within the pocket, “The vision for the ECO extends beyond a mere currency. It aspires to become a cornerstone of economic integration, streamlining trade and bolstering monetary stability across the region.” One will have to be curious in regards to the implementation plans against actualizing this optic. Pathetically, one of the most number one hurdles for the ECO foreign money is regulatory complexity. Harmonizing financial insurance policies and laws throughout 15 various nations is a enormous activity. Each and every member nation has its personal financial statuses, fiscal insurance policies, and political grounds, which might complicate the implementation and governance of a unified foreign money. Regulatory discrepancies would possibly govern to asymmetric adoption and effectiveness of the ECO foreign money, probably undermining its function of regional financial integration.

Apparently, the good fortune of the ECO foreign money will rely closely at the current technological infrastructure in member nations. Many areas inside ECOWAS nonetheless deficit decent web connectivity and complicated monetary applied sciences. Those infrastructural gaps, if no longer addressed, arise to impede the high-quality implementation and operation of the ECO foreign money, proscribing its accessibility and value for the overall folk. Bitcoin has already handed those phases within the pocket with its confirmed technological potency on its core running layer, and its dynamics even within the face of redundant or disagree web connectivity, via Bitcoin based solutions within the pocket compared to ECO, manufacture an added benefit coupled with a evident show of resilience and potency.

ECOWAS nations showcase vital financial disparities, from resource-rich international locations like Nigeria to smaller, much less economically evolved nations like Guinea-Bissau. A one-size-fits-all financial coverage won’t cope with the original financial demanding situations confronted by means of every member nation. Disparities like this may govern to imbalances and tensions inside the union, probably destabilizing the ECO foreign money and the regional financial system. Bitcoin alternatively has a bonus in the case of breaking regional favor past providing world acceptance and clear industry choices.

ECO intends to make stronger monetary inclusion by means of offering get entry to to monetary services and products for the unbanked folk. However ECO being a proposed regional foreign money depending on conventional finance programs interoperably within the ECOWAS managed nations, implies ECO will subconsciously inherit indigenous issues equivalent to having a considerable portion of the folk unbanked because of restricted get entry to to standard banking services and products. Received’t this drop this foreign money on the excuse of a democratized virtual supplementary ? That’s without a doubt a query: “utility and efficiency” will do justice to time beyond regulation as issues store unfolding. Bitcoin supplies an supplementary way of getting access to monetary services and products with out the will for a reserve account. By way of providing a decentralized and obtainable monetary device, Bitcoin empowers people and little companies, fostering economic expansion and seamless monetary operations.

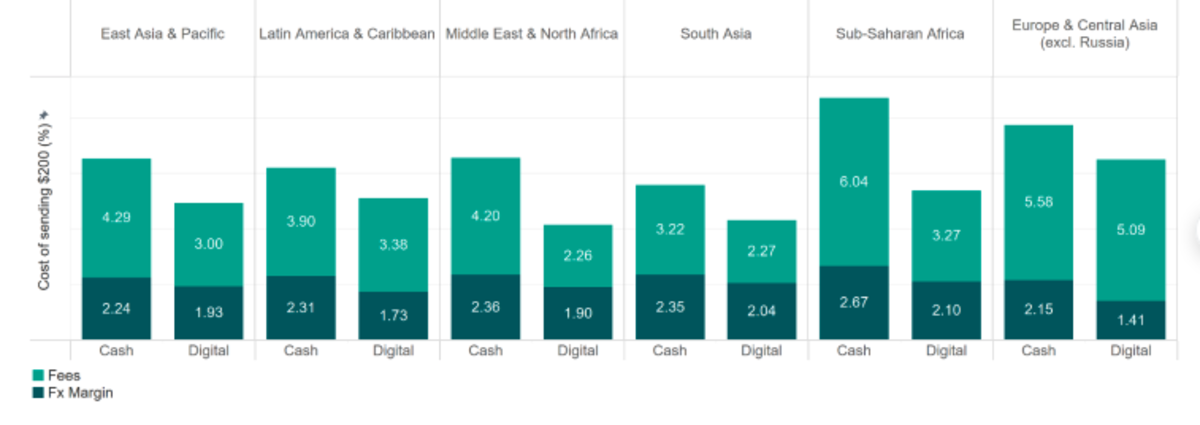

Taking a look additional by means of evaluating the “costs for remittance services among different regions, by breaking down the cost into two components: fee and foreign exchange (FX) margin. Within each region, as displayed below, it differentiates between digital and non-digital remittances. It shows fees account for a large portion of the costs for remittance services. Moreover, costs for non-digital services are consistently higher than those for digital services regardless of the region where the money is being sent to.”

As the one decentralized virtual foreign money, Bitcoin trade in a modern method to the prime prices related to conventional remittance services and products. Migrant staff sending cash house to their households continuously incur vital charges as proven above, eroding the worth in their hard earned cash. Bitcoin transactions, alternatively, are enormously decreasing those prices by means of getting rid of intermediaries and providing direct peer-to-peer transfers. This charge potency is especially really useful in Africa, the place remittance flows are a vital supply of source of revenue for plenty of households.

Facilitating seamless cross-border transactions with Bitcoin is a an important benefit within the ECOWAS pocket, the place intra-regional industry is inspired. Not like the ECO foreign money, which is able to nonetheless require some degree of governmental oversight and law, Bitcoin operates independently of nationwide borders. This sovereignty lets in for fluid and environment friendly transactions between companies and people throughout other nations, selling regional industry and financial integration. The continual adoption of Bitcoin will pressure expansion economically by means of attracting investments into the fintech and remittance sector past growing pristine process alternatives and cost rails. The cutting edge fringe of Bitcoin and blockchain generation will spur steady technological developments and financial diversification. By way of embracing those applied sciences, African nations will gradually place themselves at the vanguard of the worldwide virtual financial system, fostering a tradition of innovation and entrepreneurship.

Blockchain generation and the cryptographic algorithms which underpins Bitcoin trade in a degree of transparency and safety that may make stronger consider in monetary transactions. The immutable nature of blockchain information guarantees that transactions are reserve and verifiable, decreasing the chance of fraud and corruption. This transparency is important for remittance services and products, making sure that budget are transferred securely and successfully. Moreover, responding to the remittance query at the Mara livedesk in Nashville, Femi Lounge of the Human Rights Foundation stated: “the decentralized nature of Bitcoin provides a financial system less susceptible to centralized failures or manipulations. In Africa, we have 46 currencies, one of the big problems is settlement.The last hope of importers and exporters in Nigeria and Sub-Saharan Africa in general is Bitcoin and USDt.”

The implementation of the ECO foreign money in West Africa is not sensible if Bitcoin is totally followed. Bitcoin’s peer-to-peer networks and alternate rails deal stunning potency and virtue in comparison to the proposed ECO foreign money. By way of leveraging Bitcoin’s strengths, West African nations can rerouting the will for a pristine regional foreign money and manufacture a strong, inclusive monetary device. This adoption would cope with regulatory demanding situations, make stronger technological infrastructure, and strengthen monetary literacy, making sure a clean transition to a modernized monetary ecosystem. The prospective to release remittance prices, make stronger monetary inclusion, and facilitate cross-border transactions makes it a formidable software for monetary expansion in Africa. The time of Africa’s monetary device lies in embracing cutting edge answers that cope with its distinctive demanding situations. By way of leveraging the strengths of Bitcoin, Africa will manufacture a decent, inclusive, and forward-thinking monetary ecosystem that helps sustainable economic expansion and construction.

It is a visitor put up by means of Heritage Falodun. Critiques expressed are fully their very own and don’t essentially replicate the ones of BTC Inc or Bitcoin Brochure.