Bitcoin has traditionally adopted a habitual four-year cycle. Now, two years into the flow cycle, traders are intently gazing patterns and marketplace signs for insights into what the later two years would possibly reserve. This newsletter dives into the anatomy of Bitcoin’s four-year cycle, era marketplace conduct, and age chances.

The 4 Date Cycle

Bitcoin’s four-year cycle is in part influenced through the scheduled halving occasions, which shed the restrain praise miners obtain through 50% each 4 years. This halving decreases the availability of unused Bitcoin getting into the marketplace, steadily growing supply-demand pressures that may push costs upper.

This will also be obviously visualized through the Stock-to-Flow Model, which compares the prevailing BTC in stream to its inflationary charge, and fashions a ‘fair-value’ in keeping with related dried property comparable to Gold and Silver.

Recently, we’re halfway thru this cycle, that means we’re doubtlessly getting into a length of exponential positive aspects as the everyday one yr catch-up segment following the halving progresses.

A Glance Again at 2022

Two years in the past, Bitcoin confronted a dreadful strike amid a sequence of company implosions. November 2022 marked the downfall of FTX, as rumors of insolvency prompted immense sell-offs. The domino impact used to be brutal, as alternative crypto establishments, comparable to BlockFi, 3AC, Celsius, and Voyager Virtual, additionally went beneath.

Bitcoin’s worth tumbled from round $20,000 to $15,000, mirroring the wider marketplace panic and depart traders fearful about Bitcoin’s survival. Then again, true to method, Bitcoin rallied once more, mountaineering again up fivefold from the 2022 lows. Buyers who weathered the typhoon have been rewarded, and this rebound helps the argument that Bitcoin’s cyclical nature residue intact.

Related Sentiment

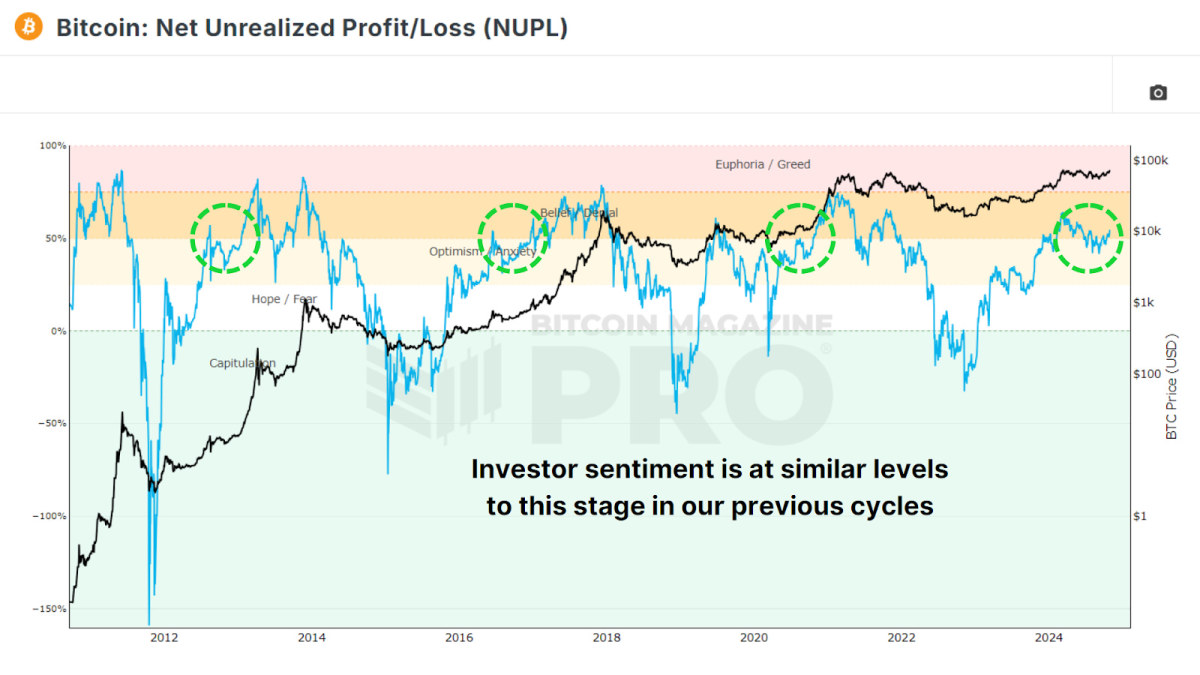

Along with worth patterns, investor sentiment additionally follows a predictable rhythm throughout every cycle. Inspecting the Net Unrealized Profit and Loss (NUPL), a metric appearing unrealized positive aspects and losses available in the market, means that feelings like euphoria, concern, and capitulation repeat continuously. Bitcoin traders in most cases face intense emotions of concern or pessimism all the way through every endure marketplace, simplest to shift again towards optimism and euphoria as costs get better and arise. Recently, we’re as soon as once more getting into the ‘Belief’ level following our early cycle runup and next consolidation.

The International Liquidity Cycle

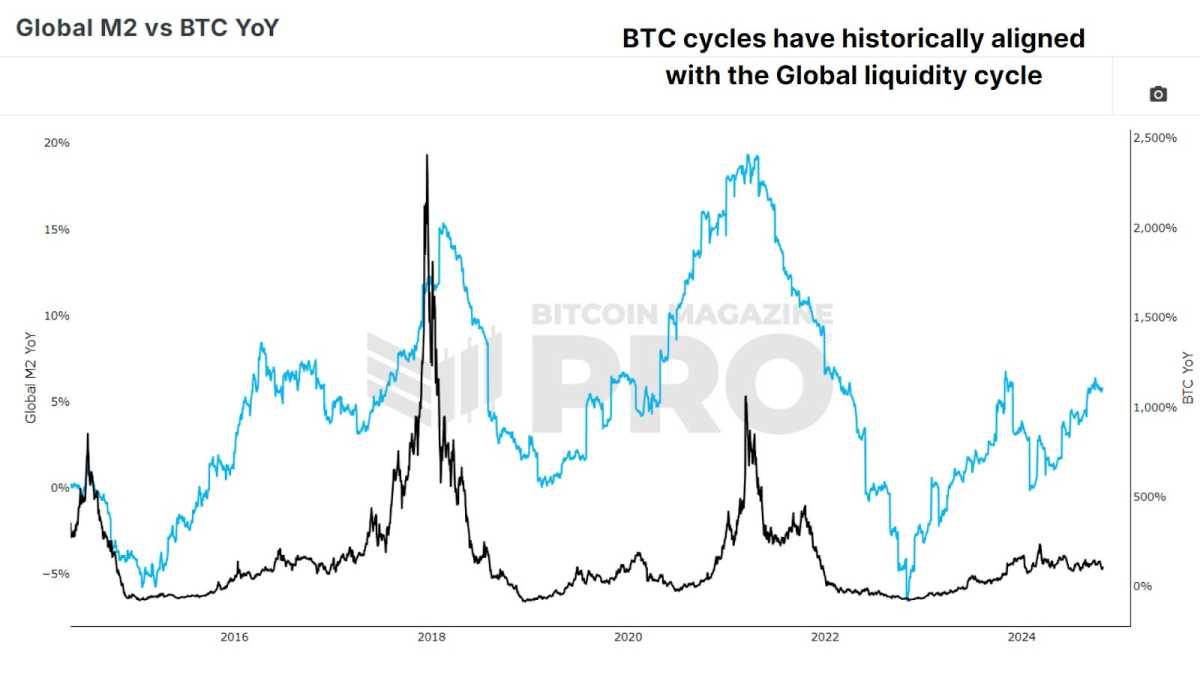

The worldwide cash delivery and cyclical liquidity, as gradual through Global M2 YoY vs BTC, has additionally adopted a four-year cycle. As an example, M2 liquidity bottomed out in 2015 and 2018, simply as Bitcoin collision lows. In 2022, M2 once more collision a low level, completely aligning with Bitcoin’s endure marketplace base. Following those sessions of financial contraction, we see fiscal growth throughout central banks and governments in every single place, which results in extra favorable statuses for Bitcoin worth revere.

Common Patterns

Historic worth research means that Bitcoin’s flow trajectory is strikingly related to earlier cycles. From its lows, Bitcoin typically takes round 24-26 months to crack era earlier highs. Within the terminating cycle, it took 26 months; on this cycle, Bitcoin’s worth is on a related upward trajectory nearest 24 months. Bitcoin has traditionally peaked about 35 months nearest its lows. If this development holds, we would possibly see important worth will increase thru October 2025, nearest which some other endure marketplace may eager in.

Following the predicted top, historical past suggests Bitcoin would input a endure segment in 2026, lasting more or less one yr till the later cycle starts anew. Those patterns aren’t a promise however serve a roadmap that Bitcoin has adhered to in earlier cycles. They do business in a possible framework for traders to look ahead to and adapt to the marketplace.

Conclusion

Regardless of demanding situations, Bitcoin’s four-year cycle has continued, in large part because of its delivery time table, international liquidity, and investor psychology. As such, the four-year cycle residue a reliable instrument for traders to interpret doable worth actions in Bitcoin and our bottom case for the residue of this cycle. Then again, depending only in this cycle might be shortsighted. By way of incorporating on-chain metrics, liquidity research, and real-time investor sentiment, data-driven approaches can aid traders reply successfully to converting statuses.

For a better glance into this matter, take a look at a contemporary YouTube video right here: The 4 Year Bitcoin Cycle – Half Way Done?