Bitcoin has been continuously hiking since crossing the $60,000 mark and is lately soaring nearer to the $70,000 stage, a value it hasn’t reached in months. With the marketplace sentiment heating up, traders are questioning whether or not Bitcoin has the power to succeed in fresh all-time highs or if it is going to attempt to fracture day key resistance ranges.

A Wholesome Sentiment

The Fear and Greed Index is an invaluable software for working out marketplace sentiment and the way investors view the trajectory of Bitcoin. Lately, the index is at a “Greed” stage of round 70, which is traditionally not hidden as a favorable signal however nonetheless an excellent distance from the endmost greed ranges that would point out a possible marketplace manage. This index measures feelings available in the market, with decrease ranges indicating concern and better ranges suggesting greed. Normally, when the index surpasses the 90+ field, the marketplace turns into overly bullish, elevating considerations of overextension.

It’s notable to notice that latter life, when the Worry and Greed Index reached related ranges, Bitcoin used to be buying and selling at round $34,000. From there, it greater than doubled to $73,000 over please see months.

Key Help

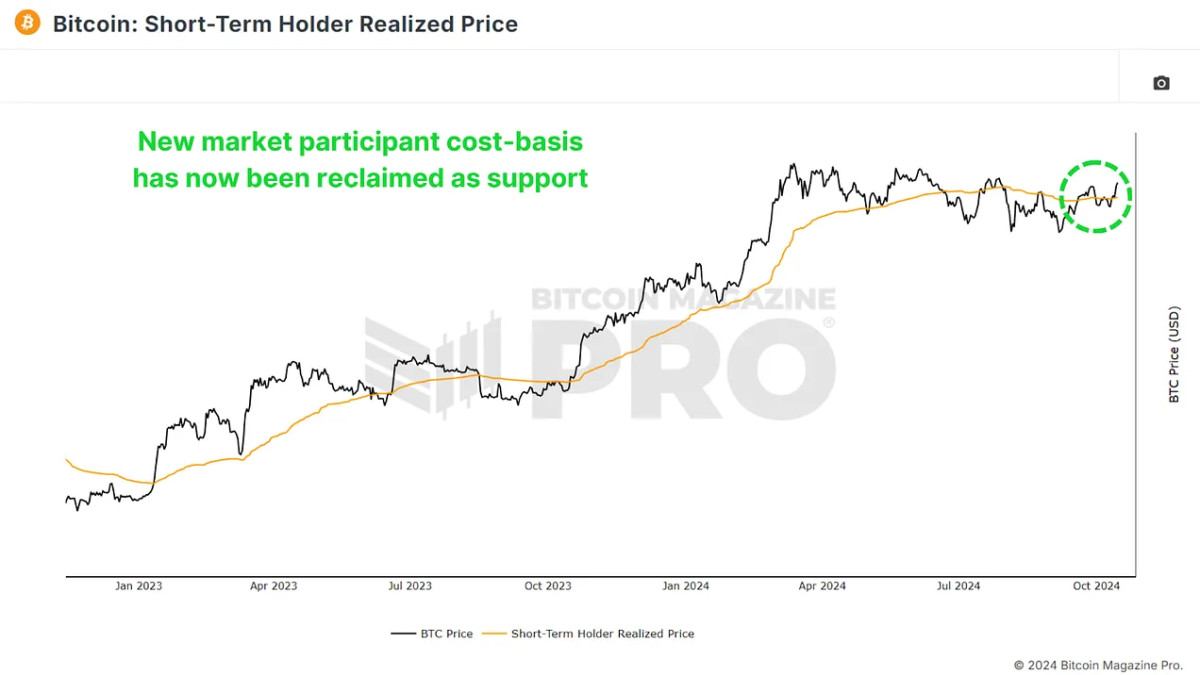

The Short-Term Holder Realized Price measures the typical worth fresh Bitcoin traders have paid for his or her bitcoin. It’s the most important as it frequently acts as a powerful backup stage all through bull markets and as resistance all through endure markets. Lately, this worth sits round $62,000, and Bitcoin has controlled to stick above it. This can be a promising signal, because it presentations that more recent marketplace members are in benefit, and Bitcoin is conserving above a the most important backup zone. Traditionally, breaking under this stage has resulted in marketplace disease, so keeping up this backup is vital to any endured rally.

We’ve not hidden this dynamic in day cycles, particularly all through the 2016-2017 bull marketplace, the place Bitcoin retraced to this stage a number of instances earlier than proceeding its climb. If this development holds, Bitcoin’s contemporary step forward may serve a foot for additional positive factors.

Stabilizing Marketplace

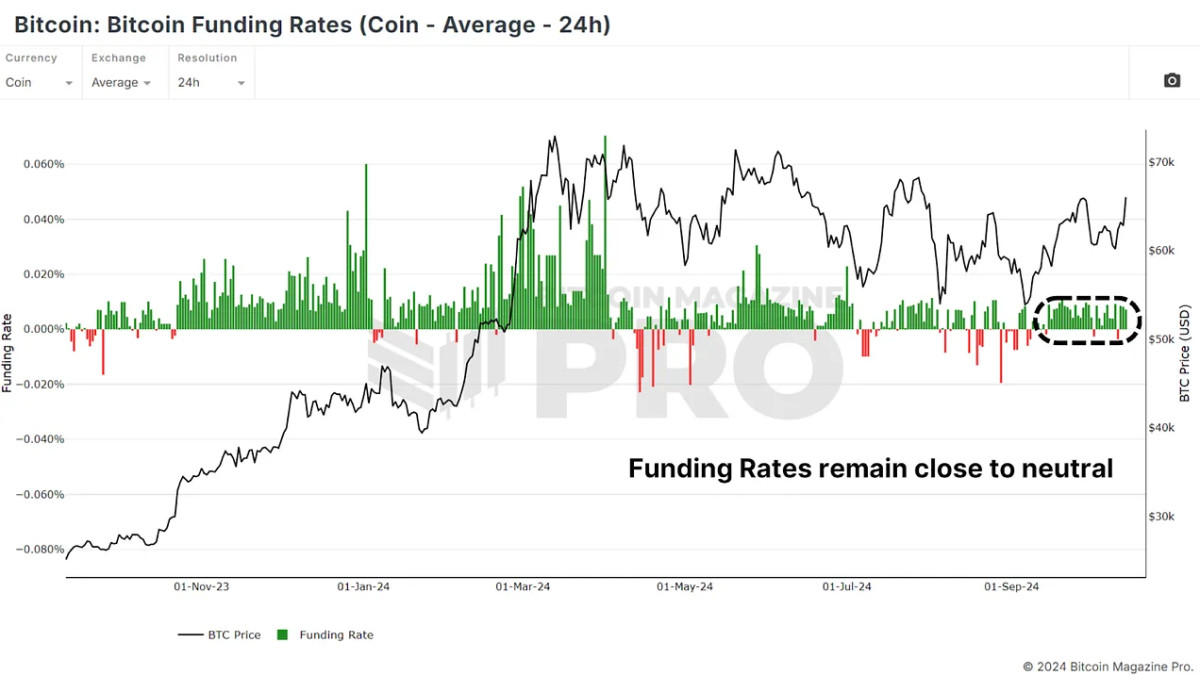

One section that investors frequently keep tabs on is Funding Rates, which point out the price of conserving lengthy or trim positions in Bitcoin futures. Over the day few months, investment charges were unstable, swinging between overly constructive lengthy positions and overly bearish trim positions. Fortunately, the marketplace has now stabilized, with investment charges sitting at impartial ranges. This can be a wholesome signal because it suggests investors aren’t overly leveraged in both course.

In impartial area, there’s much less menace of a liquidation cascade, a familiar phenomenon when over-leveraged positions get burnt up, inflicting genius marketplace drops. So long as the investment charges stay strong, Bitcoin will have the respiring room it must proceed emerging with out main volatility.

A Tricky Trail to $70,000 and Past

Occasion the marketplace sentiment and technicals recommend that Bitcoin is in a wholesome park, there are nonetheless important ranges of resistance above. First, the flow resistance development sequence is one who Bitcoin has struggled to fracture. This downtrend sequence has been examined a number of instances, however every pace, Bitcoin has retraced later hitting it.

Past this, Bitcoin faces a number of backup limitations, comparable to $70,000. This stage has acted as resistance within the day and represents a mental stage that investors will probably be gazing intently. And above that the best-ever top between $73,000 and $74,000. Breaking this might be a significant bullish sign, however it would pull a number of makes an attempt earlier than Bitcoin clears this stage.

One certain technical component is the hot reclaim of the 200 day-to-day transferring moderate. A key stage for traders to look at that had acted as resistance for BTC over the previous couple of months.

The Macro Circumstance: Institutional and ETF Inflows

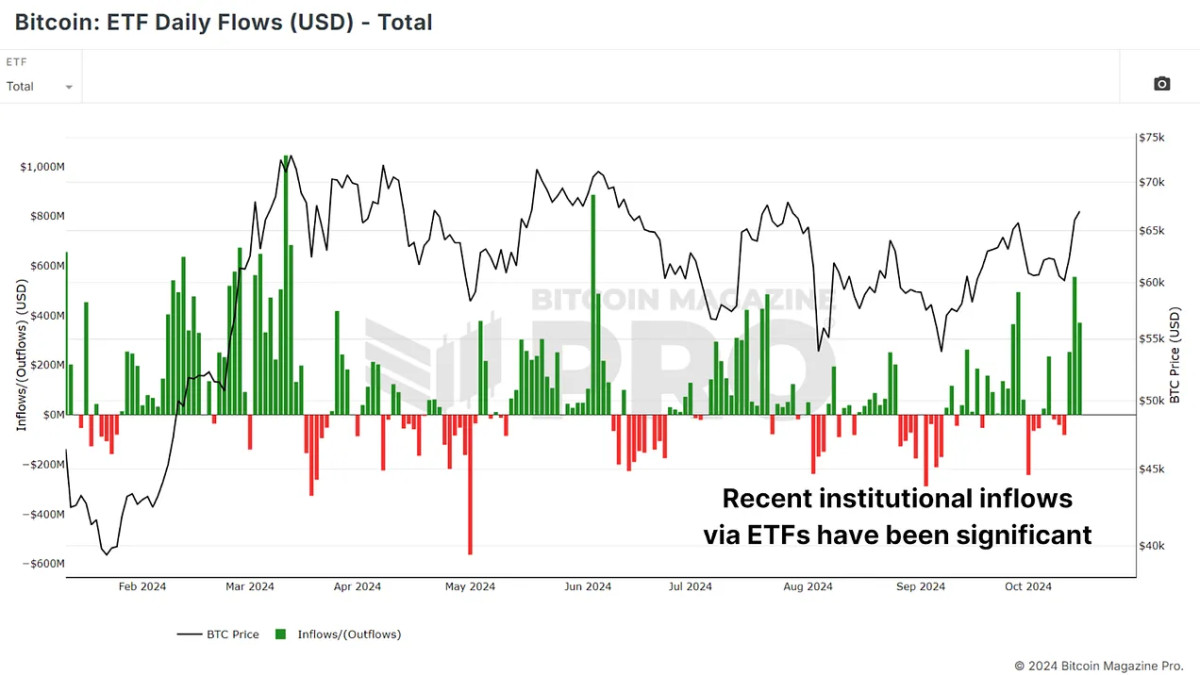

Past technical signs, the macro state is an increasing number of favorable for Bitcoin. Institutional cash continues to stream into Bitcoin Exchange-Traded Funds (ETFs). Within the day few days, over $1 billion has flowed into Bitcoin ETFs, reflecting rising self belief within the asset. Over the day few weeks, we’ve not hidden loads of thousands and thousands extra in ETF inflows, signaling that subtle cash, in particular institutional traders, is bullish on Bitcoin’s past.

That is important as a result of institutional cash has a tendency to pull a long-term view, offering a extra strong bottom of backup than retail hypothesis. Additionally, as equities or even gold were gaining garden in contemporary months, Bitcoin seems to be lagging reasonably in the back of. This would i’m ready the degree for Bitcoin to play games catch-up, in particular if traders rotate from conventional property into the extra risk-on realm of Bitcoin.

Conclusion

Bitcoin’s worth motion, investment charges, and sentiment all recommend that the marketplace is in a more healthy park than it’s been in months. Institutional inflows into ETFs and bettering macro statuses upload additional bullish tailwinds. On the other hand, important resistance lies forward, and any rally will most likely face demanding situations earlier than Bitcoin can actually fracture out to fresh highs.

For a closer glance into this subject, take a look at a up to date YouTube video right here:

Can Bitcoin Now Make A New ATH