Bitcoin’s contemporary worth volatility has led many to marvel if large-scale bitcoin hodlers are benefiting from worth dips to acquire extra bitcoin. Time some metrics would possibly to start with counsel an build up in long-term holdings, a more in-depth exam unearths a extra nuanced tale, particularly then the stream extended duration of uneven consolidation.

Are Lengthy-Time period Holders Collecting?

Upon preliminary remark, long-term Bitcoin holders are reputedly expanding their holdings. In keeping with the Long Term Holder Supply, since July thirtieth, the quantity of BTC held by means of long-term holders has larger from 14.86 million to fifteen.36 million BTC. This surge of round 500,000 BTC has led some to consider that long-term holders are aggressively purchasing the dip, doubtlessly environment the level for the upcoming vital worth rally.

Then again, this interpretation could be deceptive. Lengthy-term holders are outlined as wallets that experience held BTC for 155 days or extra. This occasion we’ve simply surpassed 155 days since our most up-to-date all-time prime. Due to this fact, it’s most likely that many temporary holders from that duration have merely transitioned into the long-term section with none pristine dozen going on. Those buyers at the moment are keeping onto their BTC, hoping for upper costs. So in isolation, this chart does now not essentially point out pristine purchasing process from established marketplace contributors.

Coin Days Destroyed: A Contradictory Indicator

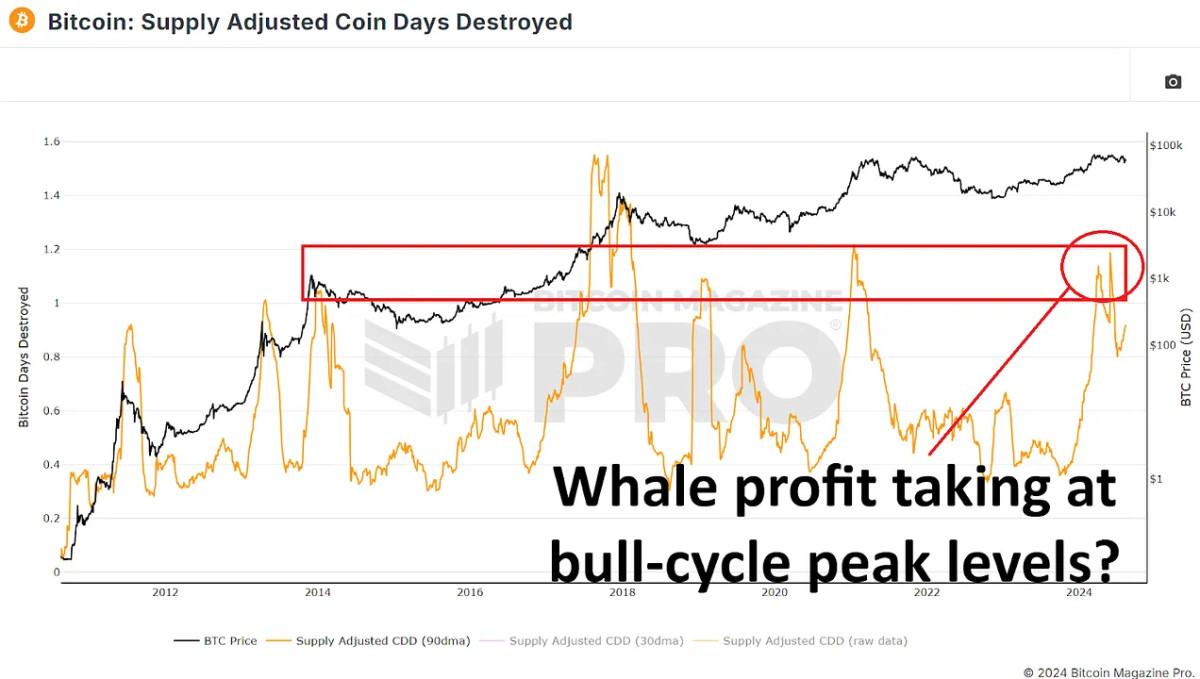

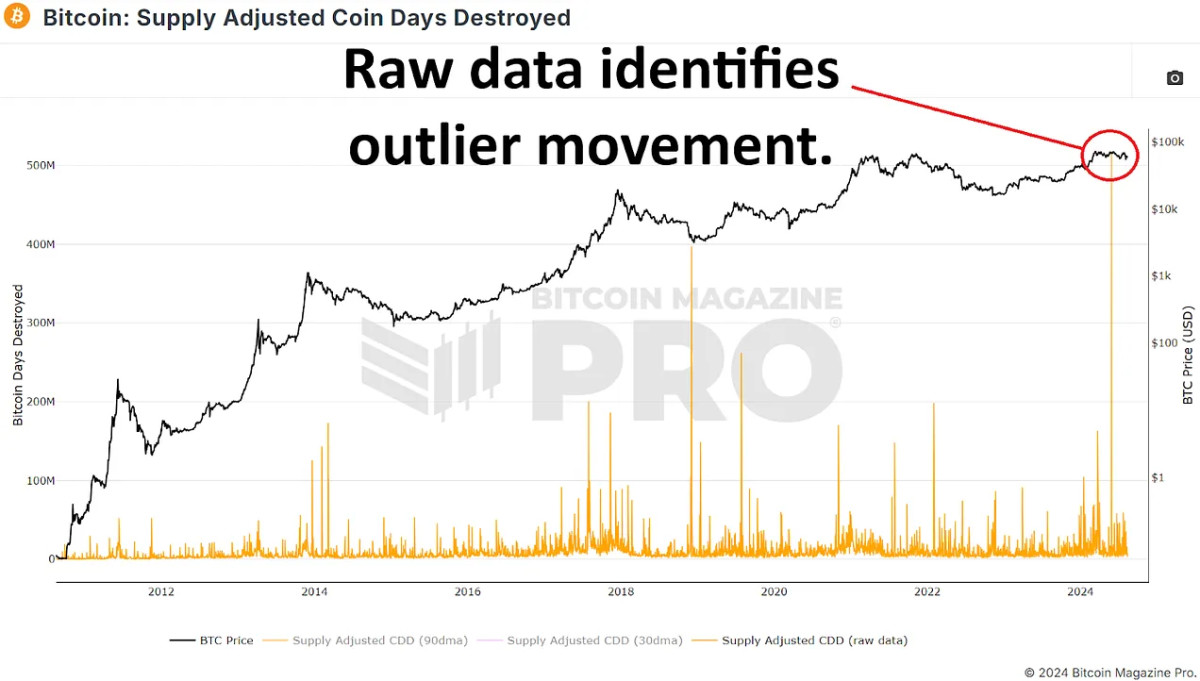

To additional discover the conduct of long-term holders, we will read about the Supply Adjusted Coin Days Destroyed metric over the hot 155-day duration. This metric measures the rate of coin motion, giving extra weight to cash which were held for prolonged sessions. A spike on this metric may point out that long-term holders possessing quite a lot of bitcoin are transferring their cash, most likely indicating extra promoting versus collecting.

Just lately, we’ve viewable an important build up on this knowledge, suggesting that long-term holders could be distributing instead than collecting BTC. Then again, this spike is basically skewed by means of a unmarried large transaction of round 140,000 BTC from a identified Mt. Gox pockets on Might 28, 2024. Once we exclude this outlier, the knowledge seems a lot more standard for this level out there cycle, similar to sessions in past due 2016 and early 2017 or mid-2019 to early 2020.

The Habits of Whale Wallets

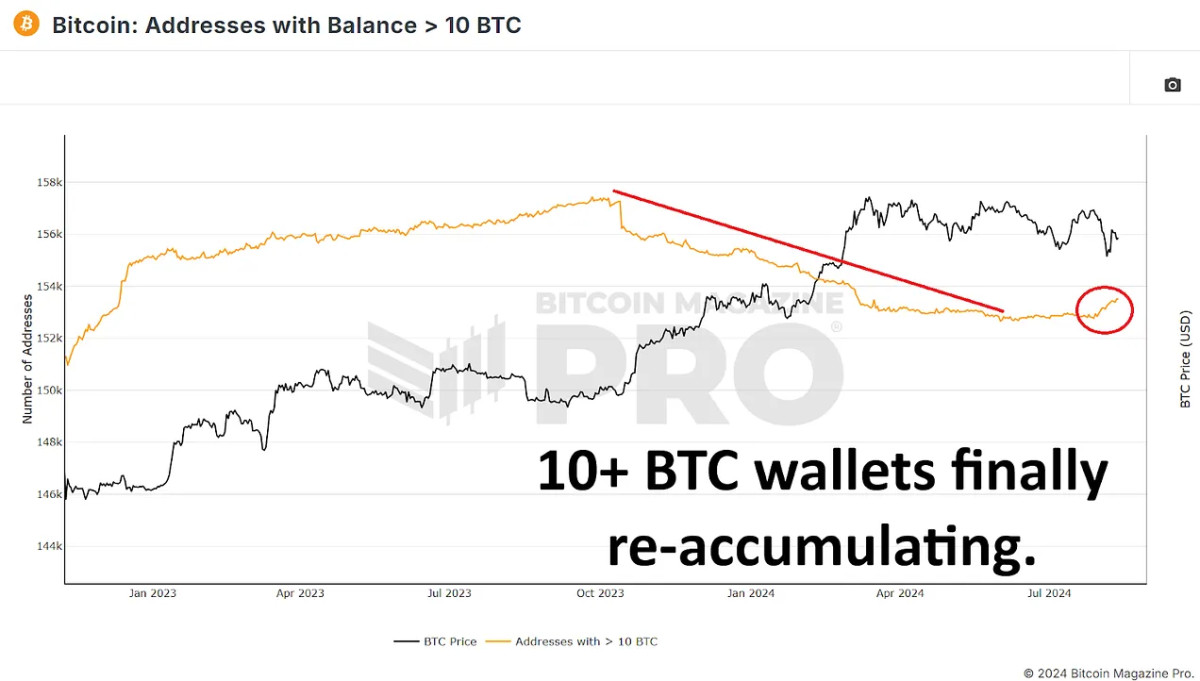

To decide whether or not whales are purchasing or promoting bitcoin, inspecting wallets keeping really extensive quantities of cash is a very powerful. By way of analyzing wallets with no less than 10 BTC (minimal of ~$600,000 at stream costs), we will gauge the movements of vital marketplace contributors.

Since Bitcoin’s top previous this presen, the selection of wallets holding at least 10 BTC has rather larger. In a similar fashion, the selection of wallets holding 100 BTC or more has additionally viewable a little stand. Bearing in mind the minimal threshold to be integrated in those charts, the quantity of bitcoin gathered by means of wallets keeping between 10 and 999 BTC may account for tens of 1000’s of cash purchased since our most up-to-date all-time prime.

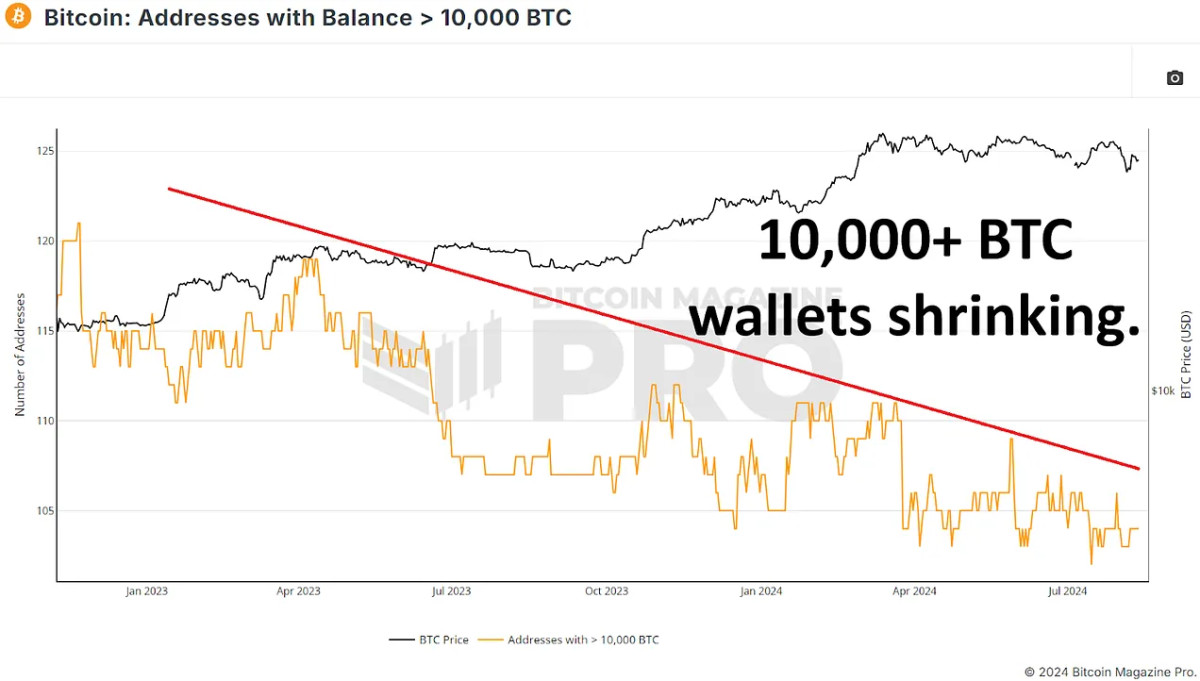

Then again, the craze reverses after we have a look at greater wallets holding 1,000 BTC or more. The selection of those extensive wallets has reduced rather, indicating that some primary holders could be distributing their BTC. Essentially the most remarkable trade is in wallets holding 10,000 BTC or more, that have reduced from 109 to 104 within the era months. This means that one of the most greatest bitcoin holders are most likely taking some benefit or redistributing their holdings throughout smaller wallets. Then again, bearing in mind a majority of these extraordinarily extensive wallets will usually be exchanges or alternative centralized wallets it’s much more likely those are a number of dealer and investor cash versus anyone person or workforce.

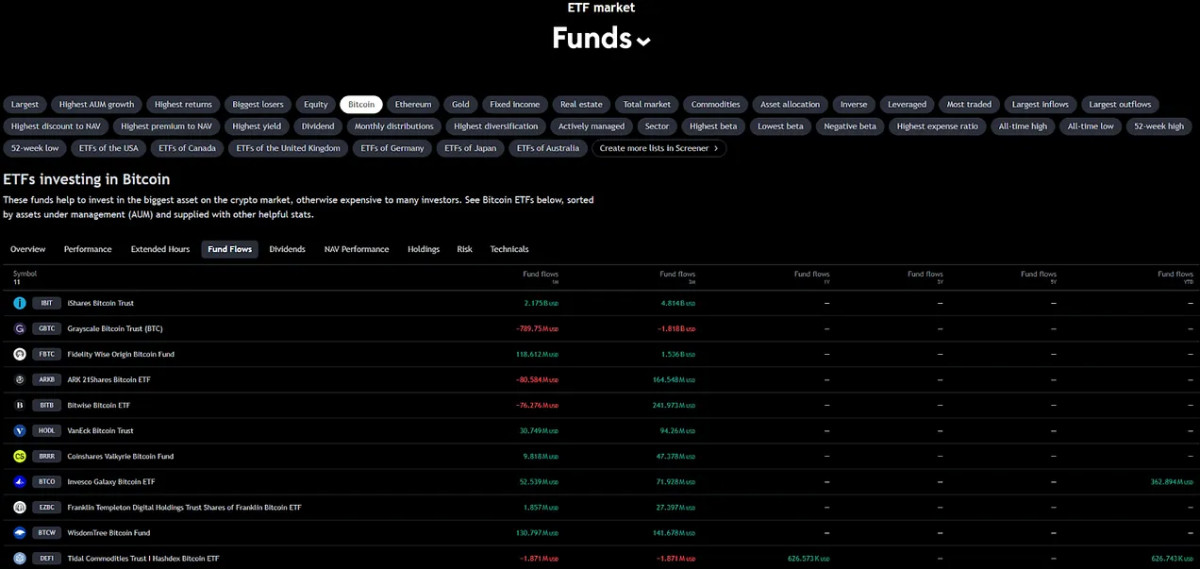

The Function of ETFs and Institutional Inflows

Since attaining a top of $60.8 billion in property underneath control (AUM) on March 14th, the BTC ETFs have viewable an AUM shorten of round $6 billion, then again when taking into consideration the cost shorten of bitcoin since our all-time prime, this more or less equates to an build up of roughly 85,000 BTC. Time that is sure, the rise has handiest negated the quantity of newly mined Bitcoin all the way through the similar duration, additionally 85,000 BTC. ETFs have helped release promoting drive from miners and doubtlessly from extensive holders however haven’t considerably gathered plenty to have an effect on the cost undoubtedly.

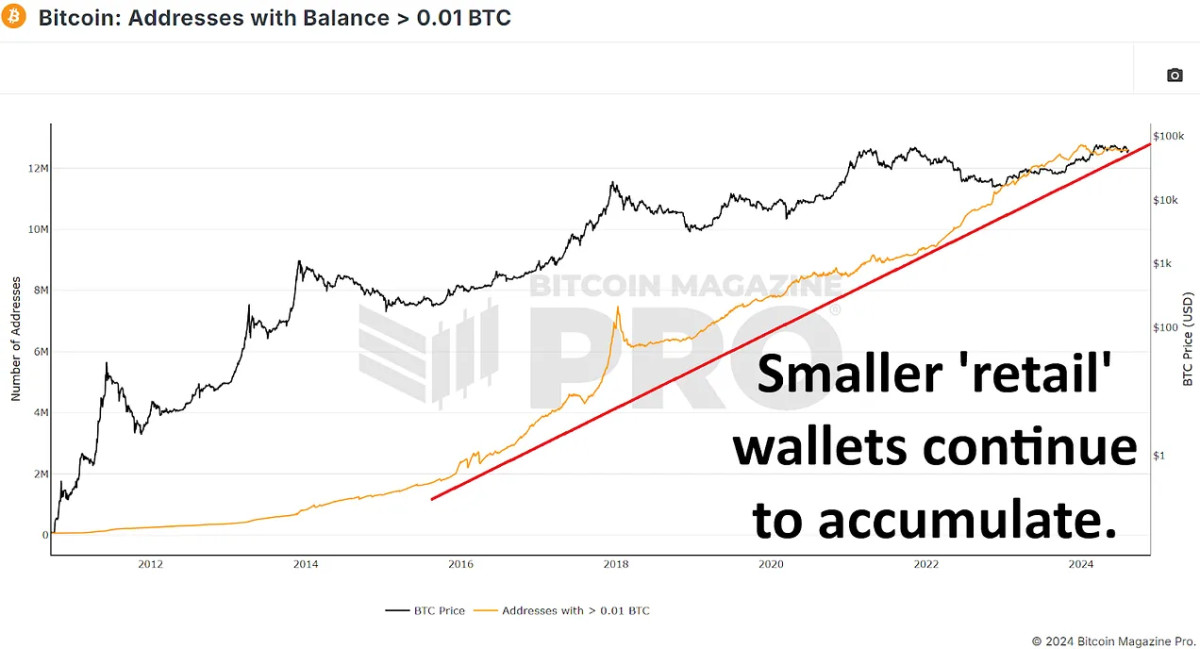

Retail Hobby at the Be on one?s feet

Apparently, occasion large holders seem to be promoting BTC, there was an important build up in smaller wallets – the ones holding between 0.01 and 10 BTC. Those smaller wallets have added tens of 1000’s of BTC, appearing larger pastime from retail buyers. There’s been a web trade of round 60,000 bitcoin from 10+ BTC wallets to smaller than 10 BTC. This will appear alarming, however bearing in mind we usually see hundreds of thousands of bitcoin transfer from extensive and long-term holders to pristine marketplace contributors right through a whole bull cycle, this isn’t recently any purpose for fear.

Conclusion

The narrative that whales were collecting bitcoin on dips and right through this era of chopsolidation does now not appear to be the case. Time long-term holder provide metrics to start with seem bullish, they in large part replicate the transition of temporary holders into the long-term section instead than pristine dozen.

The rise in retail holdings and the stabilizing affect of ETFs may serve a powerful understructure for date worth idolize, particularly if we see renewed institutional pastime and persisted retail inflows publish halving, however is recently contributing tiny to any Bitcoin worth idolize.

The actual query is whether or not the stream distribution section seizes and units the level for a pristine spherical of dozen, which might propel Bitcoin to pristine highs within the coming months, or if this stream of used cash to more moderen contributors continues and most likely suppresses the possible upside for the extra of our bull cycle.

🎥 For a better glance into this subject, take a look at our contemporary YouTube video right here: Are Bitcoin Whales Still Buying?

And don’t omit to try our alternative most up-to-date YouTube video right here, discussing how we will doubtlessly make stronger one of the most easiest bitcoin metrics: