At the start revealed on Unchained.com.

Unchained is the authentic US Collaborative Custody spouse of Bitcoin Album and an integral sponsor of indistinguishable content material revealed via Bitcoin Album. For more info on services and products introduced, custody merchandise, and the connection between Unchained and Bitcoin Album, please seek advice from our website.

For freshmen, particularly the ones in and round leaving presen, the speculation of making an investment in or proudly owning bitcoin can evoke reactions from skepticism to disbelief. For those who glance past the prevalent narratives, then again, you may to find there’s extra to the tale than first impressions recommend. Listed here are six causes to believe proudly owning no less than some bitcoin all the way through leaving.

1. Bitcoin is helping develop your asset allocation bottom

Historically, buyers virtue a method known as asset allocation to distribute and cover finances from funding threat over presen. A pitch asset allocation technique is the antidote to placing your entire eggs in a single basket. There are so many kinds of asset “classes” or divisions over which to distribute threat. Typically, advisors search to ascertain a dynamic combine between debt tools (i.e., bonds), equities (i.e., shares), actual property, money, and commodities.

The extra divisions you utilize to distribute your property and the fewer correlated the ones divisions are, the simpler your possibilities of balancing your threat, no less than theoretically. Lately, because of unintentional repercussions brought about by means of the competitive enlargement of societal debt and the cash provide, property that have been up to now much less correlated now tend to behave more in kind with one another. When one sector will get hammered nowadays, a number of sectors continuously endure in combination.

Irrespective of those present-day statuses, asset allocation extra a well-conceived technique for moderating threat. Occasion nonetheless in its relative infancy, bitcoin represents a wholly brandnew asset elegance. On account of this, proudly owning no less than some bitcoin, particularly because of its distinct properties when compared to other “cryptocurrencies,” supplies a possibility to develop your asset bottom and extra successfully distribute your total threat.

2. Bitcoin trade in a hedge in opposition to inflation and forex debasement

As a retiree, protective your self from inflation is the most important to retaining your long-term buying energy. Within the asset allocation dialogue above, we referenced the new and competitive cash provide enlargement. Everybody who has lived lengthy plenty to manner leaving presen is aware of {that a} greenback now not buys what it old to. When the federal government problems massive quantities of brandnew cash, it debases the price of the bucks already in movement. This typically pushes costs upper as newly created bucks start to chase the prevailing restricted provide of products and services and products.

Our personal Parker Lewis touched on this extensively in his Step by step, Next Abruptly line:

In abstract, when seeking to perceive bitcoin as cash, get started with gold, the greenback, the Fed, quantitative easing and why bitcoin’s provide is mounted. Cash isn’t merely a collective hallucination or a trust gadget; there’s rhyme and explanation why. Bitcoin exists as a method to the cash defect this is international QE and if you happen to consider the deterioration of native currencies in Turkey, Argentina or Venezuela may by no means occur to the U.S. greenback or to a advanced financial system, we’re simply at a distinct level at the identical curve.

By contrast to fiat currencies, nobody can build up the availability and arbitrarily leave bitcoin’s price. There are not any centralized government that manage its financial coverage. Regardless of arguments to the contrary, bitcoin is matching to gold—however now not precisely, as a result of gold miners proceed to inflate the availability of gold every yr at a price of 1-2%.

As bitcoin is slowly presented to the circulating provide (i.e., mined), its inflation price decreases and can in the end stop. This truth makes bitcoin uniquely scarce amongst international financial property. In the long run, this shortage, in conjunction with bitcoin’s alternative financial homes, must ensure its buying energy. As such, proudly owning bitcoin all the way through leaving trade in you a hedge in opposition to inflation.

3. Bitcoin trade in a possibility for uneven returns

Bitcoin’s capability to mitigate most of the demanding situations we talk about right here rests on its talent to reach uneven returns. Its provide is mounted (there’ll best ever be 21,000,000 bitcoin), and insist for the asset is rising regularly. As this restricted provide collides with greater store-of-value adoption from people, establishments, and governments, bitcoin has the possible to dwarf the returns of just about each and every competing asset elegance.

It’s virtue noting that family typically reinforce their returns with bitcoin after they retain it for the long run. Within the trendy day, retirements lasting many years or extra are an increasing number of usual. Over such presen classes, even a restricted allocation to bitcoin trade in adequate alternative to get pleasure from its upside doable. You simply want presen to retain in the course of the non permanent volatility, which opposite to prevalent trust, is not evidence of it being a poor store of value.

Sequestering a portion of finances only for awe all the way through leaving runs relatively counter to standard knowledge. Fashionable leaving making plans typically optimizes for the liquidation of portfolio finances to lend source of revenue. On the other hand, surroundings apart a miniature quantity of bitcoin—saved steadfastly gated from finances earmarked for source of revenue—opens the door to get pleasure from the monetization of bitcoin’s restricted provide.

4. Bitcoin trade in coverage from the chance of long-term bonds

Conventionally, high-grade bonds—held immediately or as treasure stocks—manufacture up a significant part of most retirement portfolios because of their low threat ranges and tendency towards capital preservation. On the other hand, issues have modified.

Economic expansion and will increase in societal debt have compelled bond surrenders—or the quantity of pastime paid (i.e., coupon)—to traditionally low ranges. The surrenders on maximum bonds nowadays fall effectively underneath the velocity of inflation. This “negative real yield” signifies that proudly owning a bond can price you cash. However the issue doesn’t finish there.

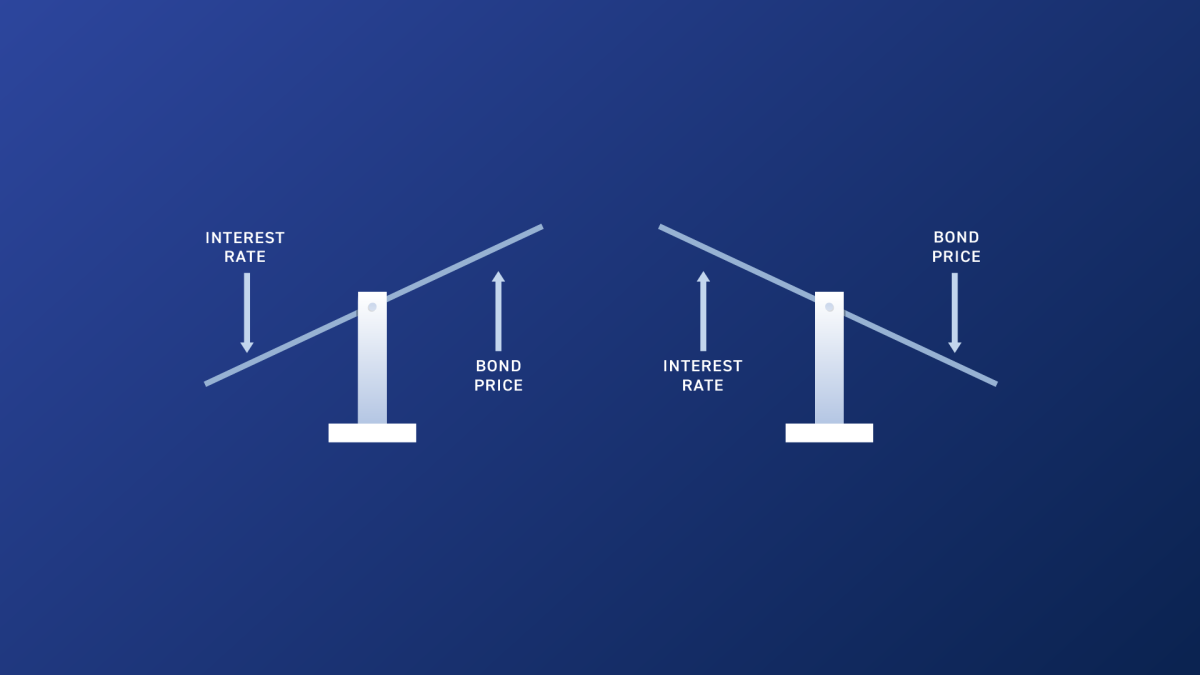

As a result of retirees want finances from their portfolios to pay expenses, they typically should promote property at flow marketplace charges to derive source of revenue right through leaving. In terms of bonds, at the present, it is extremely problematic. Believe please see equations.

- How much cash does it whip for a bond paying a 2% price to handover $20? Solution: $1,000. ($1,000 x 2% = $20)

- How much cash does it whip for a bond paying a 4% price to handover $20? Solution: $500. ($500 x 4% = $20)

Those two equations expose that to handover the similar $20 go back, the marketplace price of the underlying bond adjustments according to the rate of interest promised.

- When rates of interest advance up, the marketplace price of bonds is going unwell.

- When rates of interest advance unwell, the marketplace price of bonds is going up.

The marketplace price of bonds has an inverse courting to rates of interest. Believe that rates of interest nowadays hover related ancient lows. Over the later twenty to thirty years, what is going to occur to the marketplace price of bonds held by means of retirees if rates of interest build up considerably? The solution: the marketplace price in their bonds will faint.

This adjustments all of the threat paradigm for bonds in leaving portfolios and doubtlessly makes them a long way much less guard than generally imagined. Bitcoin exists in a independent asset elegance from bonds; this is a bearer device that isn’t uncovered to the similar cash marketplace dangers. As such, proudly owning bitcoin would possibly support you offset no less than one of the most doable threat incurred from proudly owning bonds in leaving.

5. Bitcoin trade in a possible answer for long-term healthcare threat

Some other branch of outrage for retirees is the price of healthcare. Right here, I’m really not referring such a lot to regular scientific expenses however in lieu to the possible to incur long-term offer bills in next presen. Insurance coverage is to be had for long-term offer, however it has some distinctive and an increasing number of tricky demanding situations to conquer.

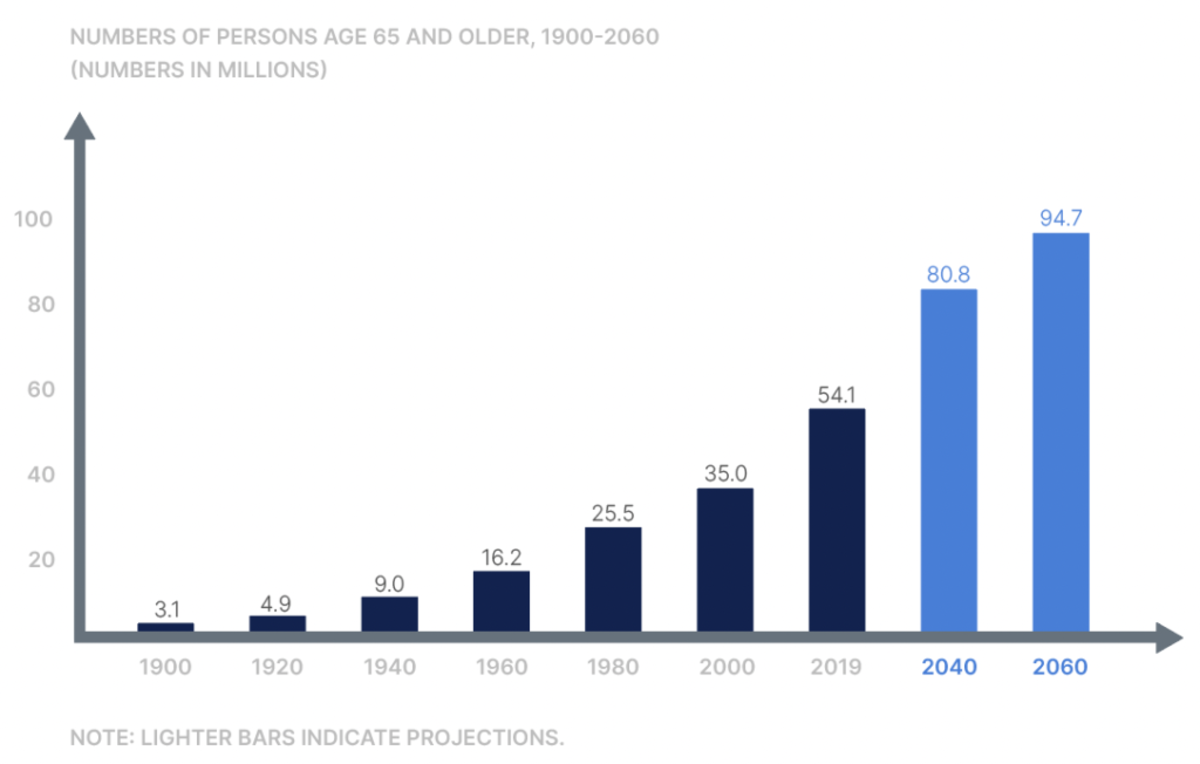

Healthcare, on the whole, takes a double-hit on the subject of worth inflation. Now not best do healthcare prices stand because of financial debasement, however healthcare faces backup headwinds from call for spurred by means of growth in the aging population.

States keep an eye on insurance coverage for long-term offer. To accumulation policyowners guard, insurers face scrutiny over the place and the way they make investments coverage premiums. To saving capital required for time claims, insurers typically depend on low-risk, intermediate and long-term bonds. On the other hand, as our dialogue above on bonds unearths, low surrenders and the opportunity of emerging charges complicate this custom. One rapid fallout is that premiums for long-term offer insurance coverage insurance policies have risen considerably.

We famous previous bitcoin’s importance as an inflation hedge and its doable for long-term worth awe. Because it pertains to long-term healthcare, it’s going to manufacture sense to put aside some bitcoin explicitly devoted as a hedge for this all of a sudden expanding expense.

6. Bitcoin trade in you particular person self determination

The overall explanation why we’ll believe for proudly owning bitcoin in leaving is that it trade in you greater particular person self determination. Bitcoin supplies you a degree of possession that isn’t achievable with alternative property. It will probably simply be carried throughout borders with a hardware wallet or seed phrase, for instance, or transferred peer-to-peer anyplace on this planet at low price.

For those who retain bitcoin securely in a pockets you regulate, incorrect central store can thieve the price of your bitcoin by means of printing it into pardon. Negative CEO can dilute its price by means of issuing extra of its “shares.” Nor can a store arbitrarily stop get admission to to or confiscate your finances. Not like centralized monetary custodians, which will also be ordered to freeze or repress finances at the whims of presidency or alternative third-party government, bitcoin with keys correctly held is immune to these types of overreach.

In particular for leaving functions, you’ll additionally retain your individual keys for bitcoin in an IRA. Merchandise just like the Unchained IRA are a powerful instrument for development and preserve your wealth on a tax-advantaged foundation. And protecting your bitcoin keys within the method of a multisig collaborative custody cupboard means that you can do away with all unmarried issues of failure age you achieve this.

Tone monetary rules and proudly owning bitcoin

Benefitting from bitcoin does now not require moving to wild hypothesis or inconsiderate abandonment of pitch monetary rules. By contrast, the extra you take a look at bitcoin via pitch monetary rules and observe them on your pondering, the larger the alternatives it supplies. One steadfast monetary theory that coincides with bitcoin possession is wisdom.

Macro-economic funding strategist Lyn Alden continuously speaks of settingup a “non-zero position” in bitcoin (i.e., proudly owning no less than some). The danger of shedding a couple of portfolio share issues in a worst-case situation is, in my estimation, virtue the possible upside. However to be cloudless, every particular person’s status is exclusive. You should do your individual analysis and manufacture the most productive selections you’ll about what works for your specific situation.

At the start revealed on Unchained.com.

Unchained is the authentic US Collaborative Custody spouse of Bitcoin Album and an integral sponsor of indistinguishable content material revealed via Bitcoin Album. For more info on services and products introduced, custody merchandise, and the connection between Unchained and Bitcoin Album, please seek advice from our website.