Getty Pictures

Getty PicturesFalling loan charges would possibly, at endmost, be bringing some sleep to embattled house owners and first-time patrons.

In a marketplace described as “frenetic”, lenders are locked in intense festival for untouched shoppers pace concurrently seeking to store directly to debtors already on their books.

On supposedly unfortunate Friday the thirteenth unloved, big-name suppliers such because the National, HSBC and NatWest diminished their constant charges. In an bizarre proceed, TSB did so for the second one occasion in a occasion.

Analysts be expecting additional cuts to come back, however agents say the concern of lacking out (FOMO) on higher offer is paralysing some debtors.

Failing to behave ahead of their flow trade in expires leaves them uncovered to a a lot more dear variable price.

Nationwide obsession

All over the endmost couple of years, loan charges have featured in discussions from chats across the dinner desk to election debates.

About 1.6 million current debtors had rather reasonable fixed-rate offer expiring this yr. Masses of hundreds of attainable first-time patrons were hoping to get a playground of their very own.

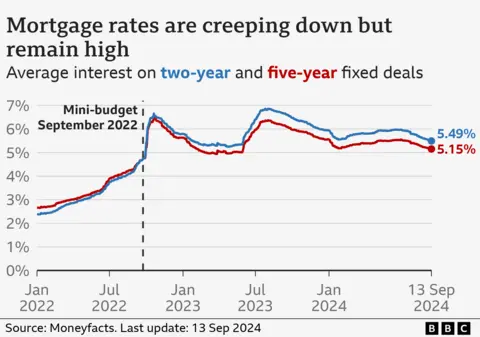

But, charges were unstable and far upper than what was once the norm for greater than a decade.

The rate of interest on a hard and fast loan does now not trade till the trade in expires, in most cases then two or 5 years, and a untouched one is selected to switch it.

Reasonable charges on untouched offer at the moment are 5.49% for a two-year trade in, the bottom for greater than a yr. 5-year offer have a mean price of five.15%, in step with the monetary knowledge carrier Moneyfacts.

Then again, the most efficient, so-called headline, charges are reserved for the ones borrowing a mini share of the worth of the house (referred to as loan-to-value). A couple of are at ranges now not visible since charges shot up following the mini-Finances within the short-lived premiership of Liz Truss.

“Momentum is really starting to build now and the cuts are coming thick and fast.,” mentioned Emma Jones, managing director at dealer When The Locker Says Refuse.

“Borrowers are the winners as lenders seek to compete for all-important market share as we head into the final months of the year.”

‘We took the plunge’

The Locker of England’s rate of interest shorten in August, with the opportunity of extra to come back, is a part of the cause of falling loan charges.

That got here quite too overdue for Johnny and Sophie Abbott, whose endmost loan trade in expired on the finish of July.

Johnny Abbott

Johnny AbbottWhen they spoke to the BBC in March, the couple from Loughborough, who’ve 3 youngsters, admitted each and every choice looked like a raffle.

In any case, they selected to shop for a house that wanted renovation.

“We took the plunge and can just about deal with the mortgage,” mentioned Mr Abbott. “It will be great when it’s done.”

In June, the Locker of England mentioned 3 million families would see their mortgage payments rise within the nearest two years, and about 400,000 loan holders had been dealing with some “very immense” payment increases.

A couple of months in the past, Gary Rees expected to have to make serious lifestyle changes when his flow trade in expires in October. Now, issues are taking a look higher.

Yet, typical of many, the benefit is a smaller rise in his monthly mortgage repayments, not a fall. To be blunt, the financial punch won’t hurt as much.

“It’s progressed, however my loan price continues to be prone to double, instead than triple,” he said.

He is expecting to settle on a two-year deal, in the hope of further rate falls. The Bank of England’s next interest rate decision is on Thursday, although analysts are predicting a hold at 5%.

Getty Pictures

Getty PicturesThese two cases show that, although things are looking more positive for borrowers, not all are getting an equal benefit. Savers, meanwhile, are seeing the interest they receive worsen.

Brokers say that lenders have been offering the best deals to new, house-purchasing customers, rather than those who are remortgaging.

With relatively few buyers, providers are trying to get a piece of a small pie, according to David Hollingworth, of broker L&C. That includes offering loans at higher multiples of income, up to 5.5 times.

He said that while the lowest rates were “now not divebombing”, the market was frenetic.

The market could also improve for remortgagers, he said, as lenders try to hit year-end targets.

Hour to behave?

Mr Hollingworth said the danger for any borrowers endlessly waiting for even lower rates to come is that they do nothing.

If a fixed deal expires, then borrowers automatically move on to their lender’s standard variable rate – which currently carries an average interest demand of 7.99%, which is two-and-a-half percentage points higher than a new two-year deal.

Adviser Jo Jingree, director of Mortgage Confidence, said people in the process of buying or remortgaging could still switch to a better deal if rates continued to fall before their personal deadline.

“I’ve visible first-hand that buyers were in a position to reach revised loan trade in at the decrease charges which is able to save them cash on their per 30 days bills,” she said.

Borrowers should monitor their rates, particularly a few weeks before their mortgage completes, to ensure they are getting the best possible rate, said Aaron Strutt, of broker Trinity Financial.

He expected rates to keep falling, especially if the Bank of England cuts the base rate on Thursday, or later this year.

With the cost of funding mortgages coming down, some in the industry suggest lenders could have cut rates more quickly.

They say lenders are making smaller price cuts week after week when they could be making larger reductions in one go.

Ways to make your mortgage more affordable

- Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

- Move to an interest-only mortgage. It can keep your monthly payments affordable although you won’t be paying off the debt accrued when purchasing your house.

- Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.

Read more here.