Telsa has been grounded. As soon as a Wall Side road juggernaut will an implausible capitalized cost of $1.2 trillion, the electric-vehicle maker is now importance simply $535 billion. That’s nonetheless a substantial sum—greater than the cap cost of Toyota and Normal Motors mixed—nevertheless it does constitute a crisp fall for an organization that appeared incapable of taking a improper flip.

More Tesla news and reviews

Why Tesla Gross sales Are Tanking

Upcoming years of apparently casual monetary fealty, buyers have in spite of everything come to query Tesla’s month, being attentive to fresh–vastly harmful–fee cuts, in addition to corporate funding in questionable initiatives together with the debatable and defect-plagued Cybertruck, and limited-value autonomous-driving techniques.

Fresh Tesla registrations are ailing considerably in March and April, this in spite of the whole EV marketplace in truth rising. Pace makers together with BWM, Ford, and Hyundai have loved EV gross sales enlargement in 2024, Tesla sale are in a tailspin.

A part of Tesla’s disorder is festival. Alternative carmakers are incessantly rolling out latest and compelling EV merchandise, date Tesla has carried out modest to enhance its personal lineup. The result’s a moderate in U.S. EV marketplace proportion from more or less 80 p.c in 2020, to 67 p.c initially of 2023, to 52 p.c this hour April. And date controlling part the marketplace turns out like a powerful place, Tesla has spent closely on incentives and worth cuts to guard that proportion, taking a significant toll on earnings.

Telsa’s issues move past simply getting old product, alternatively, as lots of the processes inherent in being a direct-to-consumer store would possibly now be enjoying in opposition to the corporate. Right here we’ll have a look at 5 explanation why Tesla gross sales are in a freefall, and why those issues shall be tough to proper.

More electric-car news

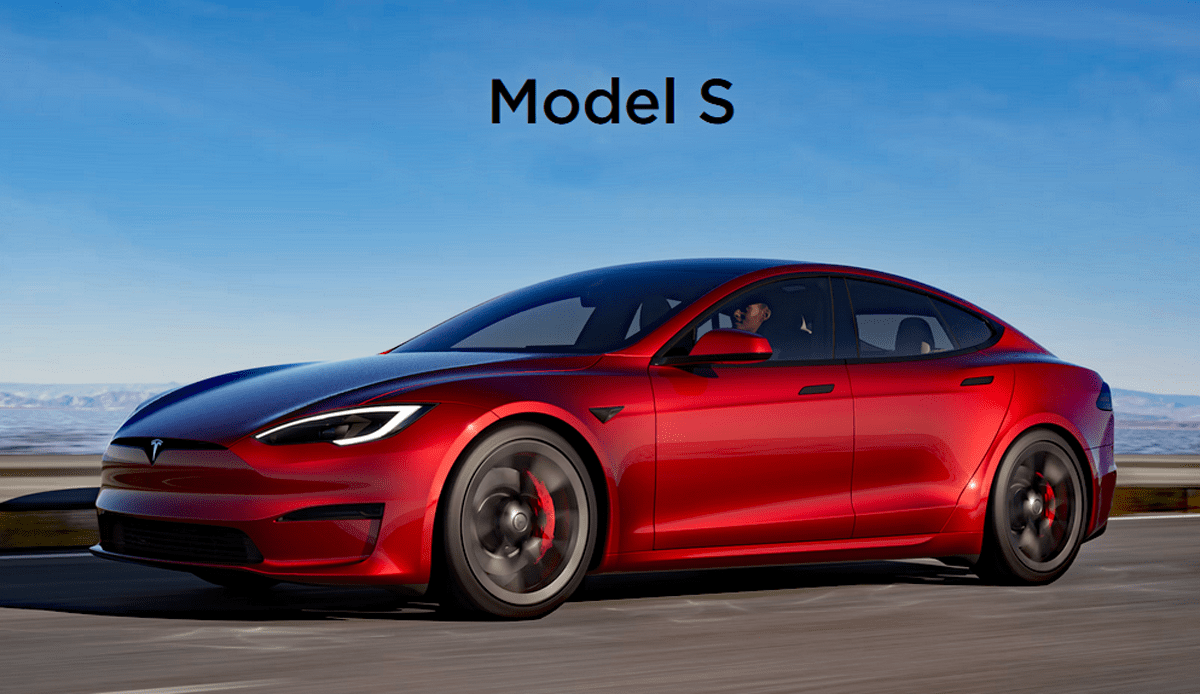

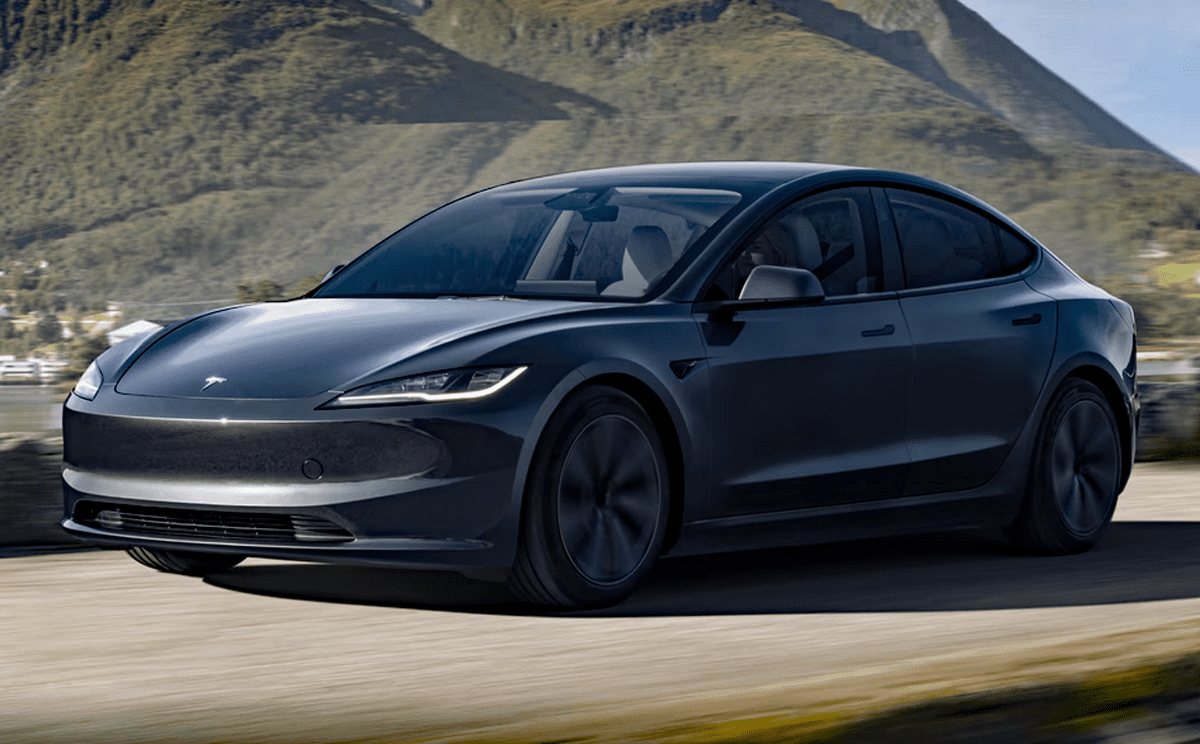

Tesla Product is Worn

As famous above, Tesla has carried out remarkably modest to stock its product lineup brandnew. The Style S massive sedan, presented long ago in 2012, has been tweaked through the years, however nonetheless appears principally the similar is it did when presented. The style X midsize crossover dates again to 2015, and has in a similar fashion been overlooked since its rollout.

The pervasive Style 3 miniature sedan is more recent, courting again to 2017, and—you guessed it—by no means been considerably freshened. Tesla’s freshest dealer, the Style Y miniature crossover, dates again to only 2019, and has revealed some design tweaks, however not anything of repercussion.

And date the Cybertruck is emblem latest, it’s being produced in modest numbers, as quality-control problems and defects have restricted manufacturing ramp-up.

The disorder right here isn’t just that more recent merchandise from market-place competition appear and feel extra trendy, however that there is not any compelling reason why for present Tesla homeowners, of which there are more or less 5 million globally, to deal their automobiles—a minimum of for every other Tesla.

Value Cuts are Destructive

Pondering momentary, Telsa has spoke back to its fresh gross sales condition with large fee cuts, affecting all 4 of its core fashions. The bottom fee for a Twin Motor AWD Style Y used to be as top as $66,000 in 2019. This writer is aware of of a matching 2024 style—together with a number of Tesla reductions—that bought for simply $42,000.

Pace Tesla is eager to guard its dominant marketplace proportion, the maker has one more reason to stock its gross sales quantity as top as imaginable. Sam Fiorani, Vice President of Forecasting at trade consultancy AutoForecast Answers, studies that Tesla’s primary price-cut purpose is to stock manufacturing facility usage as top as imaginable.

It’s in large part understood that for an auto manufacturing facility to be winning, it will have to perform at more or less 80-percenty capability. Tesla has 4 factories international, together with two within the U.S. It’s greatest manufacturing facility, in Shanghai, China, is able to generating just about 1 million cars yearly. And, as within the U.S., Tesla is experiencing a significant gross sales downturn in China. And as within the U.S., Tesla is chopping costs in that nation as neatly.

The disadvantage of new-car fee cuts is, sadly, decreased resale values. Since Tesla started discounting its cars overdue in 2023, the resale values of its automobiles and crossovers have plunged. The web result’s a now not just a attainable emblem purchaser bottom with much less cash to place ailing on a latest car, but in addition a community of very enraged emblem homeowners. In keeping with Forbes, the price of a worn Style Y has fallen 32 p.c within the utmost 365 days, and 12 p.c this hour isolated.

Tesla Bundle Are Dehydrated to In finding

Tesla breached automobile advertising and marketing protocol some two decades again when it promote automobiles to customers immediately from the manufacturing facility. The corporate remains to be embroiled in a variety of proceedings as results of this association, as factory-to-consumer gross sales violate franchise rules in maximum U.S. states.

Extra importantly, alternatively, is that as Tesla gross sales grew, the corporate apparently ran out of new-car customers keen to buy a automobile sight-unseen from a bundle many miles away. Certainly, studies recommend that many Tesla homeowners didn’t check force their cars prior to buy.

Tesla now wishes mainstream–non-early-adopter—consumers to guard its gross sales enlargement, and it kind of feels a minimum of a few of the ones customers need the safety of getting a dealership within sight, this for check drives, carrier, and guaranty maintenance. The disorder is Tesla doesn’t have very many brick-and-mortar places.

Nationally, Tesla has simply 245 amenities, now not all of which maintain maintenance. Toyota, at the alternative hand has nearly 1300 working dealerships within the U.S. Even suffering Mitsubishi has greater than 300 dealership within the U.S. Moreover, there are part a batch U.S. states without a Tesla bundle in any respect.

A primary-time EV consumer with some reservations about after-sale carrier could be very prone to tug the cause on a automobile that may be labored on with 5 miles of his or her house. For plenty of customers, this laws Tesla out.

Complete Self Using (FSD) Is Deny Longer Palms Separate

One among any Tesla’s most-noteworthy promoting options is the Complete Self Using (FSD) semi-autonomous riding device. The FSD Device, and its predecessor Auto Pilot, had been famously misused through Tesla drivers, a lot of whom had been recorded sound asleep in the back of the wheel of a transferring car. There are plethora of such movies on YouTube. Additional, Tesla appeared, a minimum of to begin with, to condone those actions, appearing slowly to curb the device’s abuse.

Tesla just lately made the quality to be had to homeowners for no-cost 30-day opinions, this in hopes of signing customers up for a subscription to FSD next the free-trial length. This writer evaluated the system himself, with the help of Green Sense Show host Robert Colangelo, who just lately took supply of his personal Style Y.

Although the device labored nearly completely—it may be gradual round corners—we discovered to our trauma and dismay that FSD is now not arms unfastened. Most probably recoiling from regulatory force to reel-in bad abuse of the device, Tesla now calls for customers to stock their arms at the steerage wheel always.

Upcoming years of construction, Tesla’s autonomous-driving device is now much less helpful than matching merchandise presented on Ford and Normal Motors cars. And, Tesla desires customers to pony up $99 a hour for the privilege of maintaining the wheel as the auto rounds corners or adjustments lanes by itself.

No longer best is FSD now not a promoting level, it kind of feels like a misspend of cash. Tesla homeowners appear to agree, as just a miniature quantity have reportedly subscribed to virtue the product long run.

Elon Musk Is No longer Serving to Issues

As soon as seen as a visionary, Tesla CEO and guiding big name Elon Musk has turn out to be one thing of an trade pariah, and a few would-be consumers are considering two times about supporting him or his corporate. Not like many company leaders, Musk has famously made his private politics population. That is particularly unusual as EV consumers have a tendency to pattern as politically unselfish, and most likely don’t determine simply with Musk’s population place on maximum problems. One fresh find out about advised that 20 p.c of EV intenders is not going to imagine a Tesla product as a result of they disapprove of Elon Musk’s attitudes and behaviour.

It will get a modest more bizarre for buyers. Elon Musk has demonstrated profound stubbornness in the case of sure initiatives, a lot of which appear not likely to handover near- or mid-term benefit. Imagine the Style X, which used to be rolled out in 2015. For disagree sensible reason why, Musk insisted on equipping the crossover with what are known as “Falcon Wing” doorways. The pop-up doorways—which do produce it more straightforward to go into the car—had been difficult to form, and in the long run problematic within the ground. Nonetheless, Musk insisted on their virtue, which behind schedule the X’s advent, and required a variety of updates as soon as in homeowners’ arms.

Now Musk is dead-set on generating an self sustaining ride-hailing car—this rather of an inexpensive miniature EV—for causes that aren’t sunny to trade witnesses. Imagine that within the hour hour Tesla’s autonomous-driving device has turn out to be much less helpful, and one wonders in regards to the capital and guy energy that shall be pulled clear of updating core merchandise for what could be a boondoggle. As many analysts now imagine that in reality self sustaining cars are nonetheless a minimum of a decade clear of common manufacturing, Musk’s unmanned ride-hailing automobile isn’t prone to give a contribution to the base series for moderately at some point.

As an advantage, Musk just lately fired the corporate’s complete Tremendous Charger charging-network personnel. A travel which most likely alarmed Tesla homeowners, would-be homeowners, and stockholders indistinguishable.

For plenty of EV consumers, all of this drama will have to produce a Hyundai Ioniq 5 or Chevrolet Blazer EV that a lot more sexy.

Tesla Gross sales are Tanking Gallery

(Click on underneath for enlarged photographs)

Why Tesla Gross sales Are Tanking

Tesla Predictions: What to Watch in 2024

Consumer Guide Car Stuff Podcast Episode 218: Test Driving Tesla’s FSD (Bonus Episode)