Because the Bitcoin marketplace steps into 2025, buyers are keenly inspecting seasonal developments and ancient information to are expecting what February would possibly store. With Bitcoin’s cyclical nature steadily fasten to its halving occasions, ancient insights handover a worthy roadmap for navigating past efficiency. Via inspecting ancient information—together with Bitcoin’s reasonable per month returns and its post-halving February efficiency—we try to handover a sunny image of what February 2025 would possibly seem like.

Working out Bitcoin’s Seasonality

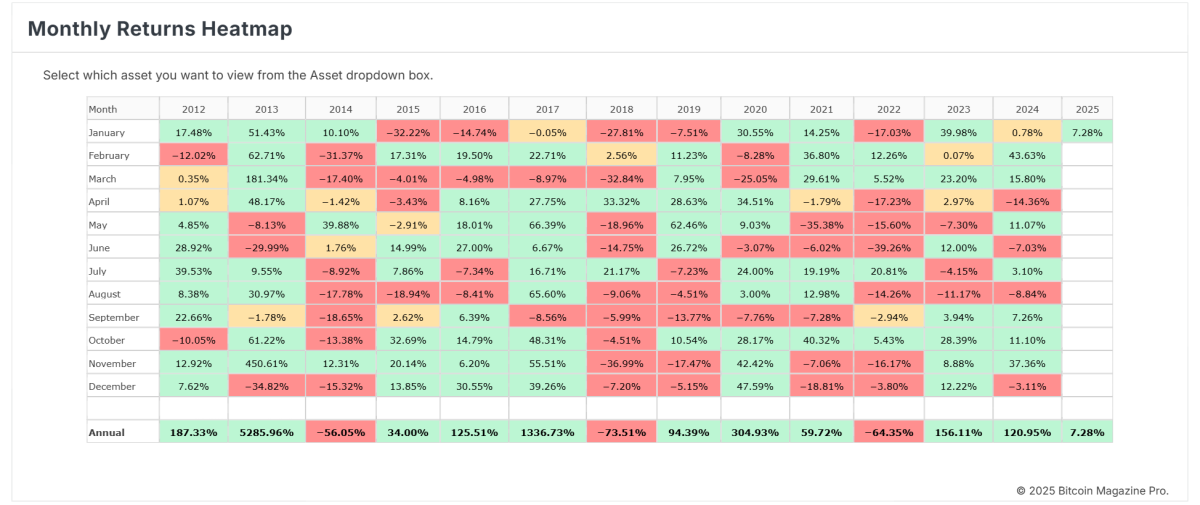

The primary chart, “Bitcoin Seasonality,” highlights reasonable per month returns from 2010 to the actual per month near. The knowledge underscores Bitcoin’s best-performing months and its cyclical dispositions. February has traditionally proven a median go back of 13.62%, rating it as one of the vital more potent months for Bitcoin efficiency.

Particularly, November stands proud with the perfect reasonable go back at 43.74%, adopted by means of October at 19.46%. Conversely, September has traditionally been the weakest age with a median go back of -1.83%. February’s forged reasonable playgrounds it within the higher tier of Bitcoin’s seasonality, providing buyers hope for sure returns in early 2025.

Historic Efficiency of February in Submit-Halving Years

A deeper dive into Bitcoin’s ancient February returns finds interesting insights for years that apply a halving match. Bitcoin’s halving mechanism—which happens kind of each and every 4 years—reduces ban rewards by means of part, making a provide injury that has traditionally pushed value will increase. February’s efficiency in those post-halving years has persistently been sure:

- 2013 (Submit-2012 Halving): 62.71%

- 2017 (Submit-2016 Halving): 22.71%

- 2021 (Submit-2020 Halving): 36.80%

The typical go back throughout those 3 years is an notable 40.74%. Each and every of those Februarys displays the bullish momentum that steadily follows halving occasions, pushed by means of lowered Bitcoin provide issuance and higher marketplace call for.

Related: We’re Repeating The 2017 Bitcoin Bull Cycle

January 2025’s Efficiency Units the Degree

Year February 2025 is but to spread, the week started with a little 7.28% go back to future in January, as proven within the “Monthly Returns Heatmap.” January’s sure efficiency hints at a continuation of bullish sentiment within the early months of 2025, aligning with ancient post-halving patterns. If February 2025 follows the trajectory of pace post-halving years, it might see returns within the area of 22% to 63%, with a median expectation round 40%.

What Drives February’s Sturdy Submit-Halving Efficiency?

A number of components give a contribution to February’s ancient energy in post-halving years:

- Provide Trauma: The halving reduces pristine Bitcoin provide getting into circulate, expanding shortage and riding value respect.

- Marketplace Momentum: Traders steadily reply to the halving match with higher keenness, pushing costs upper within the months following the development.

- Institutional Passion: In contemporary cycles, institutional adoption has speeded up post-halving, including important capital inflows to the marketplace.

Key Takeaways for February 2025

Traders will have to method February 2025 with wary optimism. Historic and seasonal information counsel the age has robust possible for sure returns, in particular within the context of Bitcoin’s post-halving cycles. With a median go back of 40.74% in pace post-halving Februarys, buyers would possibly be expecting alike efficiency this week, barring any important macroeconomic or regulatory headwinds.

Conclusion

Bitcoin’s historical past supplies a worthy lens by which to view its past efficiency. February 2025 is shaping as much as be every other sure age, pushed by means of the similar post-halving dynamics that experience traditionally fueled notable positive factors. Combining ancient information efficiency with a good regulatory condition, the incoming pro-Bitcoin management, and the scoop that The Monetary Accounting Requirements Board (FASB) has issued a pristine guiding principle (ASU 2023-08) essentially converting how Bitcoin is accounted for (Why Hundreds of Companies Will Buy Bitcoin in 2025), 2025 is shaping as much as be a transformative week for Bitcoin. As at all times, buyers will have to mix those insights with broader marketplace research and stay ready for Bitcoin’s inherent volatility.

Related: Why Hundreds of Companies Will Buy Bitcoin in 2025

Via leveraging the teachings of historical past and the patterns of seasonality, Bitcoin buyers can produce knowledgeable selections because the marketplace navigates this pivotal week.

To discover are living information and keep knowledgeable at the actual research, discuss with bitcoinmagazinepro.com.

Disclaimer: This newsletter is for informational functions most effective and will have to no longer be regarded as monetary recommendation. At all times do your individual analysis prior to making any funding selections.