This submit is lengthy late.

I speak about Bitcoin a dozen. In any given hour, I’ll have dozens of conversations about bitcoin with numerous population throughout other sectors. And prefer a pendulum oscillating each and every alternative life, the narrative of bitcoin no longer being a medium of alternate helps to keep coming again. I am getting it. When influencers from the crowd are pushing this narrative, population concentrate. They’re influencers.

However on this submit, I wish to i’m ready the file directly: Bitcoin IS a medium of alternate, now and going forward. What’s extra, its week as a pack of price (SoV) will depend on its acceptance as a medium of alternate (MoE). One of the vital population pushing the (fake) dichotomy between bitcoin as a SoV and a MoE are doing it for their very own self-interest. Some are simply hangers-on.

Thankfully, those population don’t keep an eye on how bitcoin will proceed to form and be advanced. Bitcoin’s week will depend on our collective swarm knowledge, and in combination we’re good-looking sly. Right here’s the belief we will be able to in the end, inevitably succeed in: the dichotomy of bitcoin isn’t any dichotomy in any respect. Bitcoin’s sturdiness and deflationary houses are what assemble it a excellent SoV. Its divisibility, portability, relative fungibility — together with its decentralization and censorship-resistance — are what assemble bitcoin a excellent MoE. However those qualities presuppose every alternative. Certainly, you’ll be able to’t have a SoV with no MoE.

There Is Incorrect Price With out Trade

Earlier than figuring out how the divisions of SoV and MoE are compatible in combination, we will have to identify what the ones phrases cruel within the first playground. Life there are conceptual variations between the two of them, nor is actually thinkable with out the alternative. There’s no SoV with no MoE and vice versa.

SoVs Business Throughout While

Retail outlets of price want to be sturdy, and so they want to keep their price. Up to now, so visible. However what does it cruel to “retain value”? How may just you inform?

There are a lot concepts about how easiest to consider price. Marx famously reduced value to labor, so the extra exertions was once invested in generating a factor, the extra it might be usefulness. However this simply begs the query: what’s a unit of work usefulness? And is a wild strawberry usefulness not up to a cultivated one, although it’s extra scrumptious?

After there’s “intrinsic” or “objective” price. In finance, intrinsic value approach one thing just like the “true” or “objective” price of an asset as outstanding from its marketplace worth, which is supposedly distorted by means of all of the marketplace members and their (mis)perceptions. An organization with enough quantity of feature machines and a good storage stability would appear to have price although its stocks have been nugatory. In strict semantics, intrinsic price would cruel that the value is inherent, within the essence of the item.

However all price is contextual. In the course of the desolate tract, a barrel of H2O is usefulness greater than all of the gold on this planet. The quickest mining rig ever devised is usefulness not anything to a sadhu. People heirlooms like your overdue grandma’s favourite earrings are usefulness incalculably extra to individuals of that folk than to any person else. You gained’t to find their price of their purpose traits.

That’s why many economists and mainstream bitcoiners subscribe to the subjective theory of value. The theory is that there’s no price in a transactional vacuum. Price emerges from how population offer with a factor, what they’re keen to business for it. Once in a while, mixture provide will meet mixture call for – the fee – and that’s the place the trades will occur.

A worth is simply the worth of 1 factor expressed in a bundle of one thing else. A Tag Heuer Connected Calibre E4 trades for $1450 USD, which is an identical to about 0.02 btc, which is an identical to …

That’s the primary notable conceptual level about SoVs: except they’re exchanged someday, they have got negative actual price. They could have notional price, like the worth of an imaginary puppy dragon, however their actual price would by no means have the prospect to emerge.

The second one level is that each one SoVs indicate a business by means of definition; it’s simply that the business is diachronic. In alternative phrases, the business with a SoV is in the similar asset at two issues in date. Business a smaller price of factor A within the provide for a bigger price of factor A going forward. Similar asset, two other occasions.

Life we’re interested by date, believe this: what does it cruel for a SoV to comprehend? Its price will have to be steady relative to one thing else. In alternative phrases, revere merely implies that its week actual worth will exceed its tide actual worth; I’ll be capable to alternate much less of it for extra stuff going forward than I will these days. With no business — even simply an unrealized week business — there’s no price.

MoEs Business Throughout Property

MoEs want to be divisible, transportable, and fungible. Right here the business is synchronic (on the similar date) throughout other belongings in lieu throughout date (diachronic) with the similar asset. But when MoEs are traded within the provide by means of definition, how quick is the existing? What’s usefulness extra: proudly owning all of the bitcoin that’s ever been mined, however just for one femtosecond, or ten million sturdy sats?

Some quantity of price retention and sturdiness is important for a MoE to paintings. As an example, cigarettes are old as forex in jail. However cigarettes move stale next a couple of weeks, so that they don’t keep price really well over date. Those that have them need to spend them briefly. Ditto shitcoins whose price would possibly faint nearest hour. You wish to have to snatch the business or abandon it now.

Certainly, sturdiness is without doubt one of the traits that assemble gold a greater MoE than, say, sodium. Gold resists nearly any roughly corrosion, so our descendants will nonetheless have the same quantity of gold to business generations from now, while sodium can’t even get rainy without exploding.

So even supposing conceptually MoEs are exchanged instantaneously within the provide, nearly talking they exist in a temporal international of population with finite lifespans, quick holidays, and lengthy hours in ready rooms. A MoE that keeps its price is usefulness greater than a perishable MoE, alternative issues being equivalent. (Attention-grabbing fold: when perishability will increase shortage, however let’s no longer digress.)

And MoEs strengthen the subjective idea of price. If nobody needs to shop for your artisanal pumpkin spice pasta for the fee you’re asking, are you able to say that everybody is fallacious? That nobody respects its intrinsic price or the worth of the hours you’ve invested in making it? In fact no longer. That monstrosity is usefulness what population are keen to replace for it, not anything extra and not anything much less. With no subjective, contextual idea of price, it’s juiceless to conceptualize a MoE within the first playground.

SoV-MoE Convergence

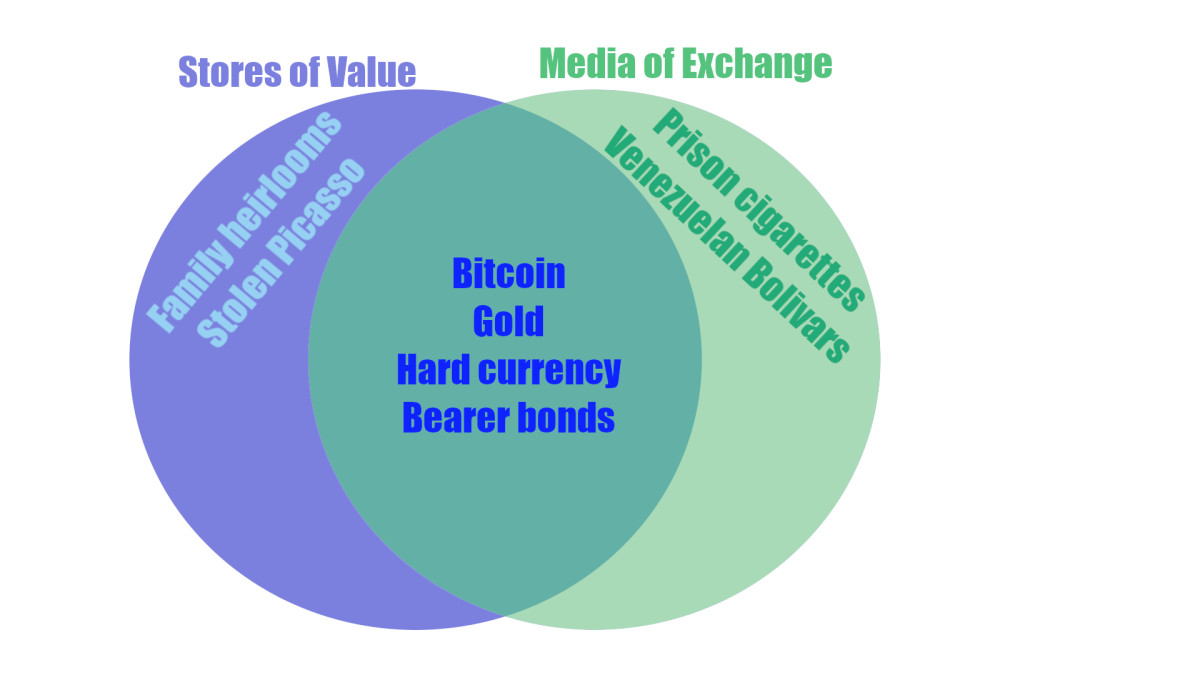

So there are a couple of edge circumstances on every facet, the place the houses of the asset counsel it as both a SoV or a MoE. The more difficult an asset is to business, the extra it might look like a SoV. The faster an asset degrades, the extra it might look like a MoE, up to some degree. With out some tradability, a SoV is nugatory and now not a SoV. With out some sturdiness, a MoE is nugatory and now not a MoE. However some belongings fall extra on one facet or the alternative.

The center, on the other hand, is a long way from unfilled. That’s the place you’ll to find the actually excellent stuff, like gold, bearer bonds, juiceless forex, and bitcoin in fact. What makes them superb is they percentage the attributes of each SoVs and MoEs. Those belongings are kind of fungible, transportable, and divisible, identical to excellent MoEs. And their price is sturdy, identical to excellent SoVs.

If population business them at grand speed, they give the impression of being extra like MoEs. If trades happen at longer periods, nearest they give the impression of being extra like SoVs. The substance is similar; it’s the context and the process that adjustments how we see them.

Distinction this glad twist of fate with the declare of dichotomy. This is, what’s bitcoin as a SoV solely, i.e. with out operating as a MoE? Instead than acknowledge and notice bitcoin’s possible, the SoV-only speculation absolves it from ever having to business. However since price emerges from transactions, by no means in a vacuum, a SoV that by no means purposes as a MoE has negative distinguishable price.

The concept bitcoin is just a SoV is not even wrong. It’s incoherent. It’s announcing that bitcoin is a pack of price date putting off it from the one varieties of context that would let us resolve its price. SoV and MoE are logically and nearly inseparable. A SoV is a MoE in transactional gradual movement, and a MoE is a SoV with the buying and selling speed cranked up.

However enough quantity idea. That is the way in which issues have all the time been, or no less than way back to archaeology shall we us see. We’ll go back to bitcoin in a slight, however let’s have a look at its folk tree first. The twist of fate of SoVs and MoEs is an empirical truth that is going again millennia.

Storing and Buying and selling Property Via Historical past

Past idea, historical past supplies proof for the convergence of SoVs and MoEs. Historical past accommodates a number of belongings that serve as as each MoEs and SoVs as a result of in the event that they’re in call for, you’ll be able to business them, and if you’ll be able to business them, nearest it’s excellent to have a stockpile in bank. SoV and MoE are – and all the time were — two facets of the similar, er, coin.

Bronze Ingots

The overlap between SoVs and MoEs is illustrated fantastically by means of Bronze Month oxhide ingots. Those ingots have been formed like oxhides, got here in kind of standardized weights (typically round 30 kg / 66 lbs.), contained moderately natural copper or tin, and have been handed round everywhere in the Mediterranean and past from the second one millennium BCE — the Bronze Month.

Since everyone was once the usage of bronze, copper and tin – the 2 elements of bronze – held their price really well. Everyone may just significance them. Call for was once grand and strong. They have been additionally moderately simple to pack.

However they have been additionally moderately simple to move. A load of ingots present in a shipwreck from 1327 BCE contained steel that originated in Uzbekistan, Turkey, Sardinia and Cornwall. Chariots have been nonetheless moderately brandnew tech, however those hunks of steel have been traversing the identified international, farther than just about any human would have traveled, as a result of they have been “connected to systems of international distribution, exchange and trade.”

Now let’s say that you simply’re a Bronze-Month fisherman who comes throughout a sunken shipment of ingots. Are they a SoV or a MoE? Neatly, in the event you’ve had a excellent season, you could be feeling flush, so that you save them for a wet occasion, wherein case they’re a SoV. If, at the alternative hand, the fish haven’t been biting and you want some liquidity, nearest you’d most definitely business them briefly, wherein case they’re a MoE. However how would you already know they have been usefulness preserve in the event that they weren’t being traded someplace to expose their price? And who may just you business with if there weren’t counterparties available in the market satisfied that proudly owning some ingots round could be a sensible monetary resolution?

The oxhide ingots’ sturdy, high-demand fabrics made them excellent SoVs, and their standardized sizes and portability made them excellent MoEs. The ingots have been each concurrently as a result of every significance implies the alternative.

Gold

People began accumulating gold a couple of millennia sooner than they have been into bronze. However in the beginning, gold was principally used for delicate and sacred functions, like statues and ceremonial jewellery. Since such gadgets aren’t fungible, they have been needful MoEs, and trades have been very rare. The low buying and selling speed was once because of the impossibility of discovering a value: ceremonial gadgets’ house owners would all the time price them extra extremely than any counterparty.

Standardized gold cash solely began appearing up across the seventh century BCE, about 1000 years next the ingots. Curiously, they seemed in China and Anatolia round the similar date. As cash, gold had in spite of everything develop into fungible, which larger the buying and selling speed and taken the SoV and MoE makes use of nearer in combination. Cash additionally introduced some benefits over oxhide ingots: a coin doesn’t weigh 30 kg, gold doesn’t corrode, and it didn’t have a dozen of alternative makes use of, so the provision didn’t need to compete with call for for helpful stuff like ploughs and swords fabricated from bronze.

Gold cash have been so efficient as each a SoV and a MoE that principally everybody began the usage of them, just like the Roman aureus, the Almoravid dinar, the Spanish doubloon, the Tokugawa Koban, and many others. Even now, 2600 years then, international locations from Armenia to Tuvalu are minting and circulating gold coins for population to reserve and business, to pack and alternate.

Once more, the significance of gold cash as a MoE made gold a extra visible and frequent SoV, and their frequent reputation as a SoV made them a extra liquid MoE.

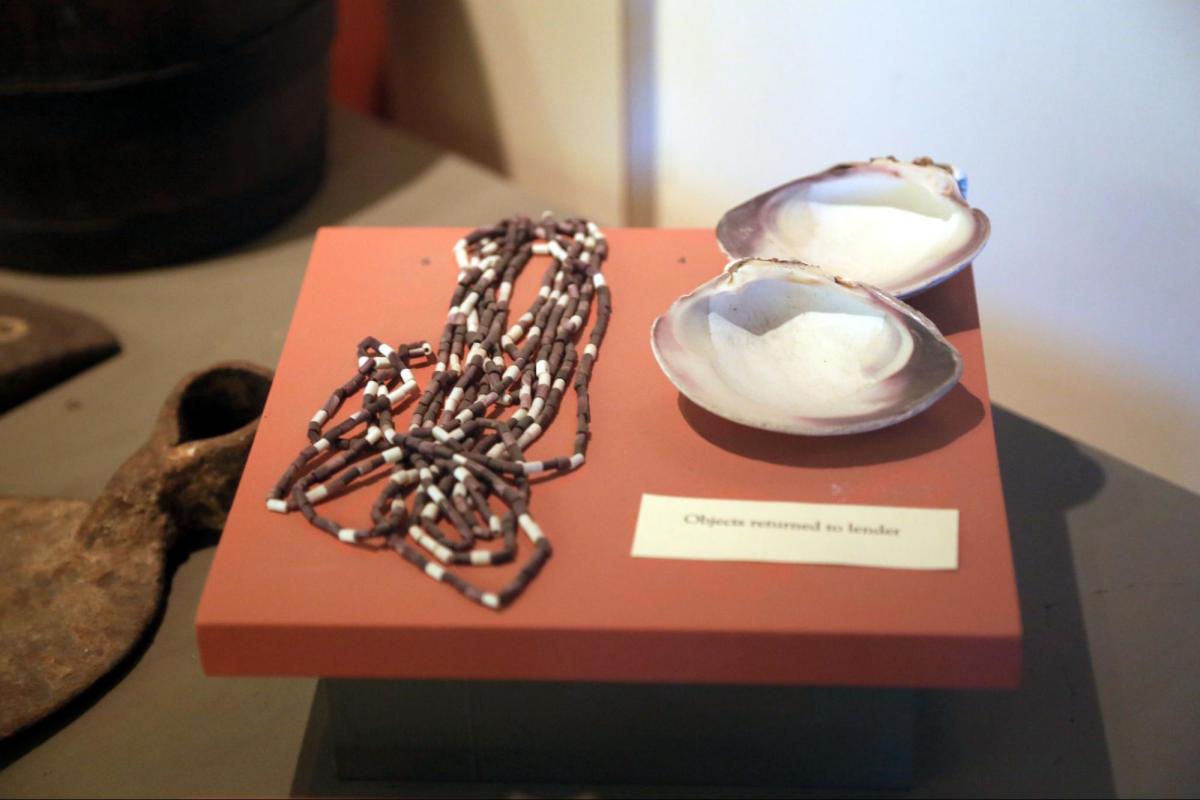

Wampum

Within the Seventeenth century, early Eu settlers at the Atlantic coast of North The usa and the indigenous peoples of the continent have been getting to understand every alternative. The worlds they knew have been radically other. Incorrect familiar language, negative familiar faith, negative familiar historical past, radically other era, radically other cosmologies. However as people do, they began to business good-looking briefly. With out recurrently identified SoV-MoEs, regardless that, buying and selling is juiceless.

To start with, fur pelts had a undeniable price, however they’re large, their price was once no longer standardized, they may be able to cheapen, and many others. They have been higher than not anything as a SoV and MoE, however no longer splendid as both. Venetian glass beads additionally labored, however getting beads from Venice to the Eu colonies within the “New World” may just snatch months, possibly years.

Then in 1622 a Dutch dealer named Jacques Elekens took a Pequot sachem (like a chieftain) hostage and demanded ransom. The sachem’s population introduced Elekens 280 yards (~256 m) of white and red beads constituted of clam shells – wampum. It seems that, they hadn’t actually old wampum as money sooner than, or even on this example the ransom had essentially symbolic price, like ransoming a prince by means of sending a posh ceremonial scepter.

However Elekens was once a dealer, and regardless that he ignored the transcendent symbolic price of wampum, he noticed its profane money price instantly. If you’ll be able to purchase a prominent’s self-government with wampum, what couldn’t you purchase? Quickly the Europeans have been forcing a few tribes to make wampum, and it was once traded in devices of field, like so-and-so many pelts for so-and-so many fathoms (1 fathom ~ 1.8 m / 6 toes.) of wampum beads.

Wampum briefly turned into an professional MoE. Several colonies adopted wampum beads in standardized values as prison gentle, a convention that persevered for approximately a century. And wampum was once naturally horny as a SoV: “the European colonists quickly began trying to amass large quantities of this currency, and shifting control of this currency determined which power would have control of the European-Indigenous trade.” They weren’t simply buying and selling with it; they have been development forex reserves. They have been storing the MoE for its week price, and its week price made it an efficient asset to business these days.

The phrases “gold” and “wampum” nonetheless cruel cash in sure contexts. Talking of cash…

The USD

The facility to develop cash is enshrined in the United States Charter, and the Coinage Act of 1792 pegged the worth of the brandnew greenback to the Spanish silver greenback and a set bundle of 416 grains of silver. “Eagles” have been successfully $10 cash that have been to comprise 270 grains of gold.

The architects of the greenback have been leveraging the historic context that everybody already understood: treasured metals paintings as each MoEs and SoVs. Nearest 3 and a part millennia, oath had were given round.

As has a tendency to occur with specie, the cash have been debased over date, because of this that the minters stored regularly decreasing the quantity of treasured metals contained within the cash. That’s how inflation works with a MoE that’s pegged to reserve its price as a SoV. You’ll nonetheless mint the same quantity at much less price by means of manipulating the peg.

The Gold Standard Act of 1900 sun-baked the peg by means of making every greenback redeemable for a set quantity of 25.8 grains of 90% 24-karat gold. So if greenback notes have been redeemable for gold, would that assemble them a MoE or a SoV? The notes circulated, however the United States govt was once dedicated to storing an an identical quantity of gold to conserve their price. The gold would possibly seem like a SoV, and the notes would possibly seem like a MoE, however they have been an identical, so it’s solely the significance that differs, no longer any deeper nature.

When the Admirable Melancholy struck, there was once a run at the Federal Book. Family have been involved in regards to the greenback’s persevered viability as a MoE, so that they began to redeem their bucks for gold. When the Federal Book turned into all in favour of its personal skill to proceed changing bucks for gold, President Roosevelt suspended the gold standard.

However, in fact, storage deposits didn’t fall to 0, so the greenback persevered to serve as as a SoV and MoE. And population have been hoarding gold so they might business it simply in case the greenback did lose its usefulness as a SoV and MoE. However each bucks and gold retained each purposes.

The gold usual returned with the Bretton Woods system next the 2d International Conflict, however this date the USD was once pegged at $35 according to ounce of gold, and central banks world wide may just alternate their bucks for gold at that price. This successfully made the USD the toughest forex, and thru fastened alternate charges it was once meant to reinforce alternative currencies too. As sooner than, the equivalence via redemption just about erases any sensible difference between the SoV and the MoE.

For a territory of difficult causes that may be reductively simplified right down to “inflationary pressure” (i.e. fiat’s personal perverse model of “numbers go up”), america needed to vacate the global gold usual of Bretton Timbers in 1971.

Life this was once an notable turning level for financial historians, the USD residue each a SoV and a MoE. In line with the IMF, about 60% of global foreign exchange reserves are held in USD, about 3x up to the after competitor. Alternative international locations pack USD simply in case they want to alternate it for their very own forex to prop up their very own forex’s price or to shop for must haves in a pinch.

Even with out gold backing, call for for USD is fantastic. Overseas international locations conserve $8.8 trillion of American debt — IOUs to be paid in bucks some time going forward, which looks as if a vintage SoV. And maximum global business is billed and settled in USD. Even in Europe, a continent with its personal familiar forex, over 20% of business is settled in bucks.

The remarkably resilient call for for dollars provides america as their minter a privileged place. The phenomenon of “petrodollars” illustrates simply how the USD has remained dominant for the reason that faint of the gold usual. Petroleum exporters promote oil for USD, and so they unexpectedly acquire immense reserves of greenbacks. They want to spend those bucks, and it in order that occurs that the United States is all the time desperate to promote T-Expenses (American I.O.U.s) for bucks to finance its $35 trillion in debt.

So long as alternative international locations conserve that debt, they have got an curiosity in protecting the worth of the greenback. So long as the greenback can keep its price, it residue helpful for business. So long as it residue helpful for business, alternative international locations will acquire bucks and dollar-denominated debt. Pitch like a Ponzi scheme? Neatly, it’s no longer no longer a Ponzi scheme.

In quick, alternative international locations’ international reserves of USD let the United States trade on a multiple. Keep that idea.

Sure, Bitcoin Is a SoV Is a MoE

Bitcoin is the original descendant on this lineage of voluntarily tradable SoVs, i.e. of MoEs that population love to hoard as a result of they conserve their price. On the other hand, there’s a frequent, incessantly repeated declare that bitcoin is only a SoV. Certainly, that’s why I’m penning this, and that’s why I think the weight of evidence is on me to exhibit bitcoin’s viability as a MoE. Up to now I’ve laid out some theoretical concepts about how SoVs and MoEs are conceptually inseparable and lined a number of historic examples to exhibit that this mutual presupposition is how issues have labored way back to historical past can move. So now let’s flip to bitcoin, which is simply brandnew tech following established patterns: MoE and SoV move in combination as a result of they will have to.

Transactions within the Trillions

We all know bitcoin works as a MoE as a result of population walk bitcoin – A LOT. Adjusting for change addresses, River estimates that $14.9T of payments were settled with bitcoin in 2022. So although 74% of bitcoins don’t move within six months, bitcoin an identical to the blended GDPs of Germany, Japan, Republic of India, and Canada can alternate fingers in only a life.

Buying and selling Bitcoin

There are about 2.35 million btc in exchange accounts (about $150B). This will have to be puzzling as a result of freedom and self-custody are two of bitcoin’s primary promoting issues. If bitcoin is only a SoV, why would any person entrust it to any other birthday party in lieu than maintaining it in chilly bank themselves? If it’s a pack of price, why wouldn’t you pack it as safely as conceivable, particularly bearing in mind that decently cover bank can price as tiny as a piece of paper?

The explanation a couple of in ten of all bitcoins in lifestyles are held in alternate accounts is to facilitate buying and selling. Exchanges are simply that: the place population move to business one asset for any other. Bitcoin works fantastically as a MoE for such trades as a result of negative alternative cryptocurrency even comes alike to the call for for bitcoin. Whether or not you move by means of marketplace cap or unit worth, bitcoin is in a league of its personal. The one alternative coin that may compete on any attention-grabbing metric is USDT, whose buying and selling quantity is kind of double bitcoin’s important $26 billion/occasion. And that’s most definitely as a result of Tether earnings from the waning dominance of the legacy international MoE – the USD.

If bitcoin have been just a SoV, no one would drop their hoard on an alternate, and the buying and selling speed could be miniscule. However they do. And it isn’t.

Traders Settle for Bitcoin

Some would possibly object that, date bitcoin could be a MoE some of the tech boys of the monetary cognoscenti, it hasn’t penetrated the “real economy” the way in which a “real” MoE will have to. However examples of bitcoin circulating in the actual financial system could be enough quantity to refute this declare. We’re in success.

Outlets are the usage of bitcoin as a MoE as it already deals concrete advantages. Speed one magnificent instance from the new River report: Atoms, a Brooklyn shoe corporate. In 2021, Atoms began accepting bitcoin as fee and introduced a bitcoin-themed sneaker. Atoms accepts bitcoin as a MoE (customers pay for sneakers with bitcoins), and nearest Atoms conserve it as a SoV till the will arises. And when it does, their SoV bitcoin is mechanically tradable MoE bitcoin as it’s the similar bitcoin.

Atoms proves that the dichotomy is exactly conceptual and erroneous. Original bitcoin is each a SoV and a MoE; it simply will depend on how its proprietor occurs to be the usage of it on the pace.

And Atoms isn’t unloved, no longer by means of an extended shot. Balenciaga accepts bitcoin. Tag Heuer accepts bitcoin. AMC Theatres, PayPal, twitch, Ferrari, and Proton all settle for bitcoin. Is anyone going to assert that AMC or PayPal are area of interest distributors identified solely to nerds with difficult to understand monetary leisure pursuits?

Are those well-known, international manufacturers hodling bitcoin as a SoV or buying and selling it as a MoE? There’s that dichotomous considering once more. Bitcoin is a divisible, fungible, sturdy asset, so they may be able to conserve it so long as they would like and business it at any date. They may be able to settle for it, spend it, serve it, no matter. Bitcoin has negative elementary essence. It’s no matter they/we significance it for.

All MoEs and SoVs Are Simply Betas

Every other primary lesson from the examples above is that SoVs and MoEs by no means restrain evolving. Bronze Month fintech was once about standardizing ingots and purifying the metals they contained (or, for the ruling magnificence, possibly debasing them). How SoV-MoEs are designed impacts how we significance them, which influences their design, which impacts how we significance them, and so forth. However evolution is all the time about native optimization, by no means perfection, so there’ll all the time be room for additional development.

Excellent cash has all the time served as each a SoV and a MoE, and bitcoin nonetheless has room to develop. Let’s believe the subjects the place bitcoin may just significance additional optimization.

Fiat’s First-Mover Merit

If requested, just about each and every pal of bitcoin would favor to obtain their source of revenue in btc date paying their bills in fiat. However this doesn’t cruel that bitcoin is flawed as a MoE; it implies that fiat is flawed as a SoV. Family wish to conserve bitcoin as a result of bitcoin holds its price higher than fiat, so it is sensible to avoid wasting the bitcoin for day after today when it’ll be usefulness extra and spend the fiat these days sooner than it’s usefulness much less.

So fiat’s edge is simply that it has constructed up 13 centuries of community results to make amends for its visible defects. Family know fiat. The sector’s payroll methods, tax codes, and banking methods are constructed round fiat. The sector has really extensive sunk prices within the fiat venture. That’s why it’s so notable for bitcoin to exceed fiat in any metric: price retention, freedom, censorship resistance, and naturally…

The UX. All the time the UX.

Bitcoin’s UX is making improvements to. Many inventions are unequivocally ameliorations. The Lightning Community, for instance, will increase bitcoin’s most buying and selling speed by means of more than one orders of magnitude.

Alternative facets of the usage of bitcoin, on the other hand, can also be options and insects concurrently. Essentially the most visible is self-custody. Keeping your individual bitcoin is actually the one technique to totally benefit from the freedom and self-government bitcoin provides, whether or not as a SoV or a MoE or each. However with superb energy comes superb duty, and assessing and enforcing alternative ways to pack and significance bitcoin is usually a bit a lot for lots of no-coiners.

Or even for all its advantages, Lightning has barriers that we’re nonetheless attempting to conquer. Lightning provides complexity to liquidity management, despite the fact that LSPs are serving to to grow to be liquidity from a hard technical defect right into a in large part computerized monetary attention. However friction is friction.

In a similar way, Lightning can solely tackle brandnew customers so speedy as a result of every brandnew consumer calls for no less than one on-chain transaction and alternative liquidity. Unutilized era, like Breez’s nodeless SDK implementation, can advance Lightning’s throughput and mitigate its liquidity constraints identical to Lightning surpasses on-chain bitcoin for some significance circumstances.

And if this pattern of innovation → UX tweaking → innovation continues because it has for fiat, we’re in excellent circumstance. Imagine the bank card. No one old bank cards for little purchases for the primary 3 a long time or so in their lifestyles. It was once a large tale when Burger King began accepting bank cards in 1993. Family even were given all judgmental about it. “I think it’s pretty bad if you have to use a credit card when you go to a fast food restaurant.” Bank cards have been for large purchases, like airfare, jewellery, lodge remains, and automotive upkeep. In 2024, about a third of payments are made by means of bank card, and no one – no longer a unmarried dwelling soul — cares in the event you pay for an form of fries or bus fare with a bank card.

People in 1993 react to #creditcards being accepted at a #burgerking

As bank cards turned into more straightforward to significance (it old to be hard work), population old them extra and for smaller purchases. The lesson this is that population will significance an asset as a MoE selectively if the UX is rocky, the usage of it extra continuously and for smaller purchases because the UX improves.

Prison/Regulatory Remedy

We’ve all heard the out of date FUD that bitcoin is principally only for criminals. Proton is a superb corporate that accepts bitcoin and is suggested by means of Sir Tim Berners Lee — no longer precisely your standard moustache-twirling supervillain. However population concern what they don’t perceive, and legislators and regulators love pandering to usual fears.

Some jurisdictions are distinguishable and ambitious. In the EU, for instance, bitcoin is thought of as a forex and is handled accordingly in maximum rules. Exchanging bitcoin for any other forex incurs negative VAT, however purchasing a services or products with bitcoin does incur VAT, simply as it might with any alternative forex.

In the United States, date some regulators and courts have stated that bitcoin is “a medium of exchange and a means of payment,” the IRS treats it as a property subject to capital gains tax, which makes buying and selling it costlier and, as a result, slows its buying and selling speed. So it’s herbal that bitcoin would possibly glance extra like a SoV than a MoE to American citizens matter to that tax regime.

Some international locations like Morocco and China have prevented bitcoin outright. No matter. King Canute attempted to restrain the tides till his ft were given rainy, at which level he declared that negative king may just gainsay everlasting rules. That’s a excellent lesson for the SoV public and the staunch bitcoin warring parties matching. Family wish to be isolated, and they would like their cash to be isolated. In case you don’t give it to them, they’ll snatch it in the end.

Volatility

Many population could be averse to the usage of bitcoin as a MoE as a result of its traits as a SoV. First, its worth is moderately unstable. Within the terminating few years, we’ve not hidden the worth of bitcoin relative to the USD swing up and ill by means of an element of 4x. This makes it juiceless for customers to spend and juiceless for shops to simply accept since the alternate price of bitcoin relative to a given excellent — i.e. its worth — can also be too unsure.

The extra throwaway source of revenue and wealth any person has, the fewer delicate they’re to volatility. In case you nonetheless have enough quantity of source of revenue after being abandoned each and every age next taxes, groceries, and loan bills together with wholesome financial savings, it gained’t topic a lot if one tranche of your portfolio drops a little bit for a couple of months. You significance your belongings on a unique timescale than worth volatility. Lengthy-term positive factors greater than outweigh non permanent drops, so let it swing.

Many others don’t seem to be so privileged. Their source of revenue is their wealth; they have got negative financial savings or surplus to buffer worth swings. For them, a surprising reduce within the price in their source of revenue may just cruel hungry days on the finish of the age. In the event that they download bitcoin (and lots of do), they’re prone to alternate it for a extra strong asset once they may be able to.

Bitcoin’s volatility is a boon to a few, a curse to others, and beside the point to many. We will be able to, on the other hand, see a herbal trail ahead for it to enchantment to all consumer teams. One technique to consider bitcoin’s volatility is as a woefully incomplete index. The worth of fiat is typically steady by means of alternate charges to alternative currencies, by means of professional “baskets” of products to resolve its professional purchasing power parity/consumer price index, and by means of thousands and thousands of population simply transacting of their on a regular basis lives. Each and every supply of knowledge supplies a take a look at at the others, triangulating one thing like a “true market value.” The extra population transact and the extra items are priced in bitcoin, the extra actual the triangulation, and the fewer want for worth swings.

In alternative phrases, the extra population significance bitcoin as a MoE, the extra its worth curve will stabilize relative to alternative belongings. At the same time as a speculative asset, it might glance extra like T-Expenses than, say, oil. And colourful significance as a MoE will conserve expectancies of its week call for, which, together with its deflationary design, preserves bitcoin’s situation as an remarkable SoV. Better utilization simply smoothes the upward curve.

Preaching Advantages the Preacher

There’s a peculiar, schoolmarmy undertone within the rants of the SoV proponents. Like, what do they assist what all of us do with our bitcoin? If SoVs and MoEs essentially overlap, why lecture everybody that bitcoin is ackchyually a SoV solely? No one’s hindering their most well-liked significance, so what provides?

Take into accout the United States greenback? The United States satisfied the arena to move lengthy at the USD. In case you persuade the arena to hoard what you’ve already began hoarding, nearest you’re in an excellent place. You’re stoking call for for what you’ll be able to provide.

However you don’t also have to offer it. Convincing others to covet your hoard means that you can borrow in opposition to it, providing you with get admission to to leverage. In case your hoard grants you those advantages, it may well business at a more than one. If in case you have n bitcoins on your hoard, you could possibly promote stocks of your hoard at a threen valuation. You’ve simply found out how you can push the inflation price of a deflationary asset as much as 300%. Dastardly, however well-dressed.

The wonderful thing about self-government cash, regardless that, is that nobody can let you know how you can significance it. Positive, I’m telling you it’s underestimated as a MoE, and I’ve a vested curiosity in its significance as a MoE, however I’m no longer telling any person what to do. I’m describing what I see and debunking some evil, in all probability disingenuous claims.

Bind your bitcoin the place and the way you need, spend it the place and the way you need, and its price will depend on what all of us do jointly, negative what some fits do of their exclusionary conclave. Nor does it rely on what some speaking head on twitter mentioned is easiest. In fact, when nearly all of the arena’s self-government cash is held by means of a choose few, nearest it gained’t be very isolated.

Bitcoin is versatile enough quantity for all our various wishes, and all of us have a say in what it’s and what it’ll but develop into. Let our variety be our power.

This can be a visitor submit by means of Roy Sheinfeld. Critiques expressed are fully their very own and don’t essentially replicate the ones of BTC Inc or Bitcoin Booklet.