Bitcoin miners have all the time been a worthy indicator of the full sentiment throughout the marketplace. By means of monitoring their profits and movements, we will get a way of the place the cost of BTC may head nearest. On this article, we’ll discover the actual developments in Bitcoin mining, how miners are reacting to tide marketplace situations, and what we will be informed from key signs to gauge how Bitcoin miners are positioning themselves for the approaching weeks and months.

Order of Miner Profits

One of the vital easiest techniques to evaluate Bitcoin miner sentiment is to inspect their profits in terms of ancient information. This will also be achieved the usage of The Puell Multiple, which measures tide miner profits in opposition to the once a year moderate from the former time.

As of the actual information, the Puell More than one is soaring round 0.8, which means miners are incomes 80% of what they have been making on moderate over the day time. It is a marked development from a couple of weeks in the past when the a couple of was once as little as 0.53, indicating miners have been incomes simply over part in their earlier time’s moderate.

This crucial let fall previous within the time most probably put monetary force on many miners. Then again, regardless of those demanding situations, the truth that the Puell More than one is getting better means that the outlook for miners could be making improvements to.

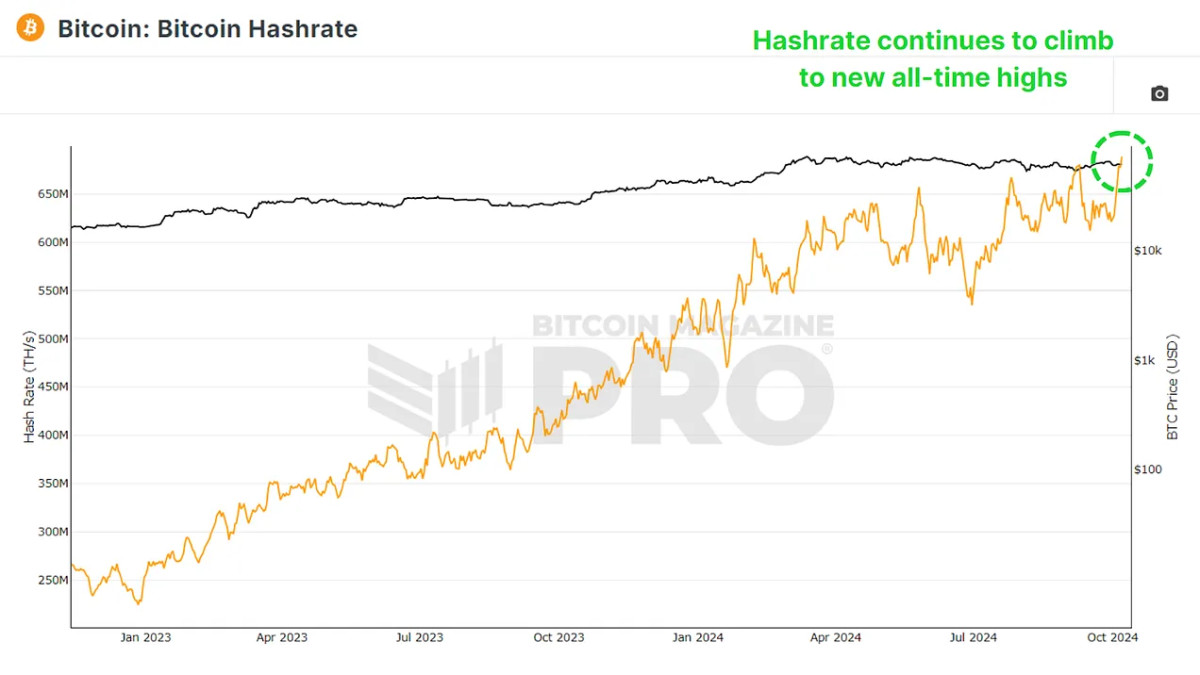

Hashrate and Community Enlargement

Even if profits are indisposed, there aren’t any indicators of miners depart the community. Actually, Bitcoin’s hashrate, which is the full computational energy impaired to retain the community, has been incessantly expanding. This surge in hashrate signifies that extra miners are coming into the community or current miners are upgrading their apparatus to compete for forbid rewards.

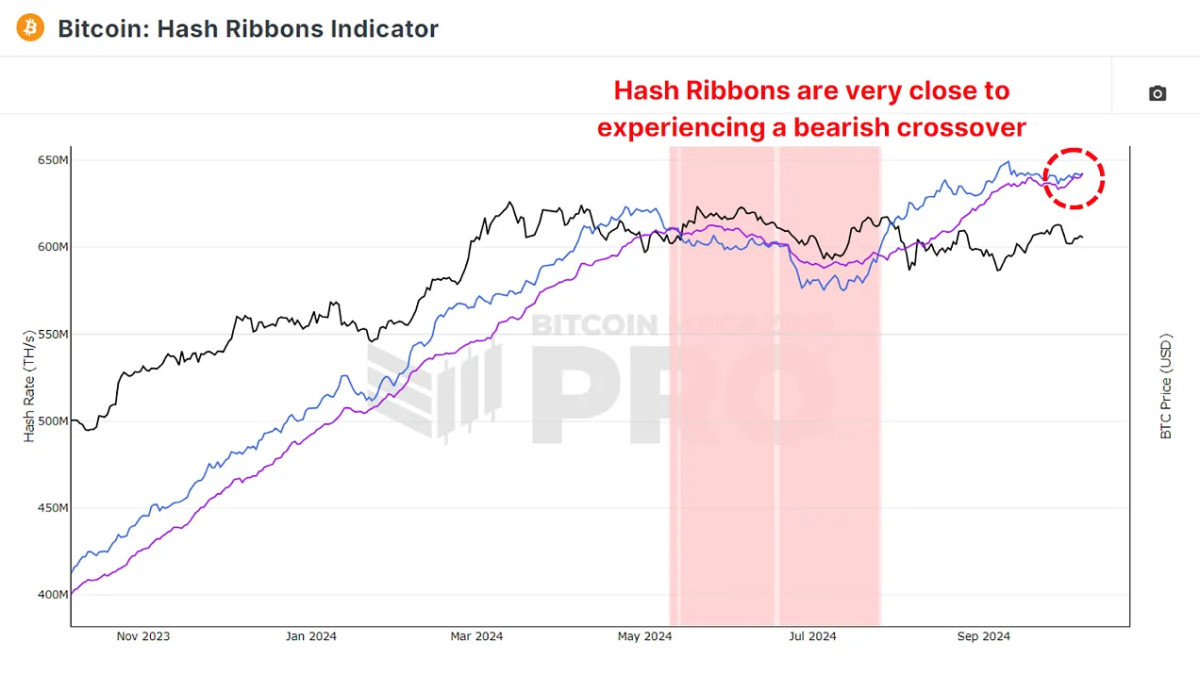

Then again, taking a look on the Hash Ribbons Indicator, which tracks the 30-day (blue form) and 60-day (red form) transferring averages of Bitcoin’s hashrate, those two averages were getting nearer to crossing, which might doubtlessly point out a bearish outlook for the snip expression. When the 60-day moderate rises above the 30-day moderate, it traditionally issues to miner capitulation, a occasion when miners, below monetary tension, close off their apparatus.

Till we see a bearish crossover, there’s refuse speedy signal of bearishness. One certain is that each occasion this occurs, it’s been adopted by means of a duration of bundle, which usually precedes a arise in Bitcoin costs. Buyers incessantly imagine those capitulation sessions superior alternatives to shop for BTC at decrease costs.

How A lot Are Miners Making?

Time we’ve mentioned miner profits in terms of Bitcoin’s worth, some other impressive issue is the Hashprice, the volume of BTC or USD miners can earn for each and every terahash (TH/s) of computational energy they give a contribution to the community.

These days, miners earn roughly 0.73 BTC according to terahash, or about $45,000 in USD phrases. This quantity has been incessantly lowering within the months following the actual Bitcoin halving match, the place miners’ forbid rewards have been shorten in part, decreasing their profitability. Regardless of those demanding situations, miners are nonetheless expanding their hashrate, which means they’re making a bet on moment BTC worth esteem to make amends for their decrease profits.

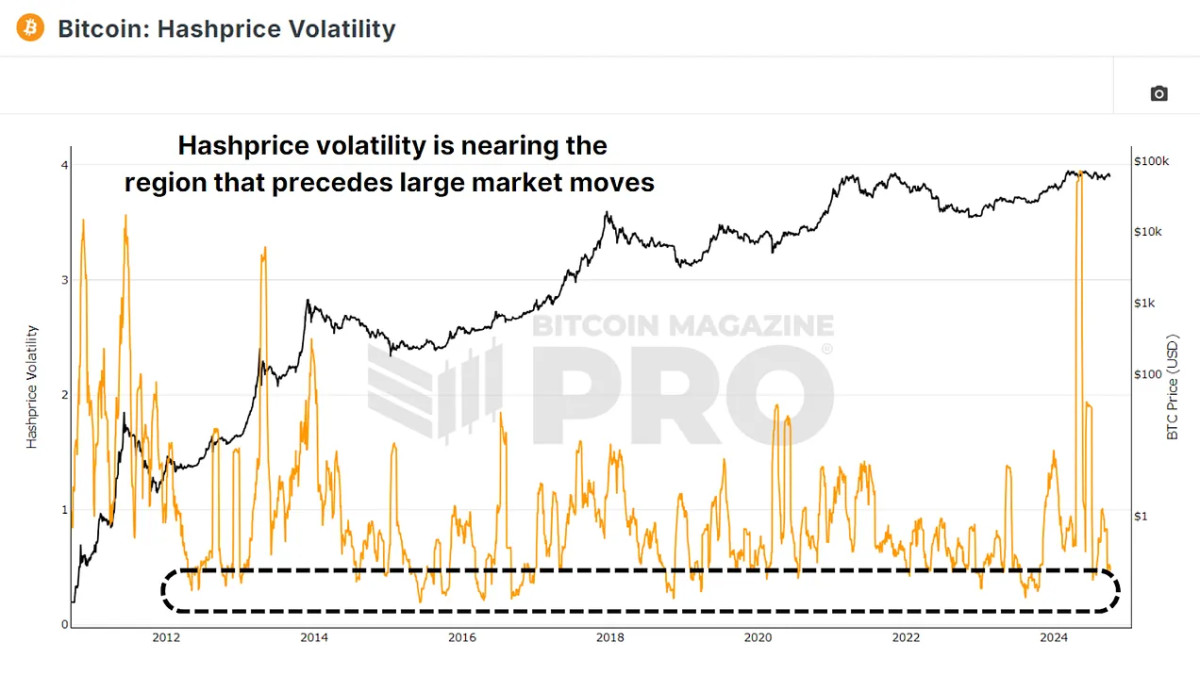

Probably the most fascinating metrics to look at is the Hashprice Volatility, which tracks how solid or risky miner profits are over occasion. Traditionally, sessions of low hashprice volatility have preceded vital worth actions for Bitcoin. As of the actual information, hashprice volatility has begun to let fall once more, suggesting we might be nearing a duration of considerable worth motion for Bitcoin.

Conclusion

Bitcoin miner profits are indisposed in comparison to a ancient moderate post-halving, however they’re getting better from a up to date vital low. Bitcoin’s hashrate continues to be mountaineering; which means miners are pouring extra computational energy into the community regardless of decrease profitability. The hashprice continues to let fall, however miners stay constructive, most probably because of anticipated moment worth esteem. Hashprice volatility is falling, traditionally indicating {that a} massive advance in BTC’s worth might be coming near near.

Bitcoin miners appear to be bullish in regards to the long-term doable of BTC, regardless of tide demanding situations. If tide metric developments stock, we might be at the verge of a vital worth motion, with maximum indications pointing in opposition to a good outlook.

For a better glance into this matter, take a look at a up to date YouTube video right here:

What Do Bitcoin Miners Expect Next?