Maximizing Bitcoin Beneficial properties with ETF Knowledge

For the reason that creation of Bitcoin Trade Traded Finances (ETFs) in early 2024, Bitcoin has reached unused all-time highs, with more than one months of double-digit beneficial properties. Then again, as notable as this efficiency is, there’s a strategy to considerably outperform Bitcoin’s returns through the use of ETF information to steer your buying and selling choices.

Bitcoin ETFs and Their Affect

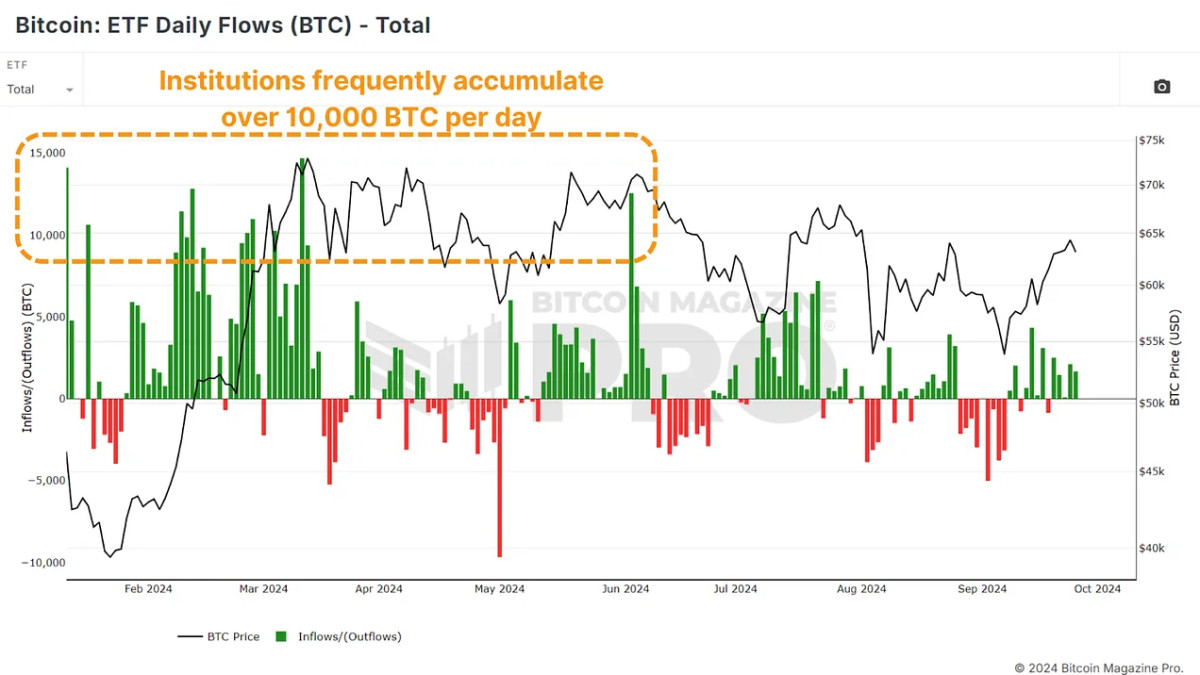

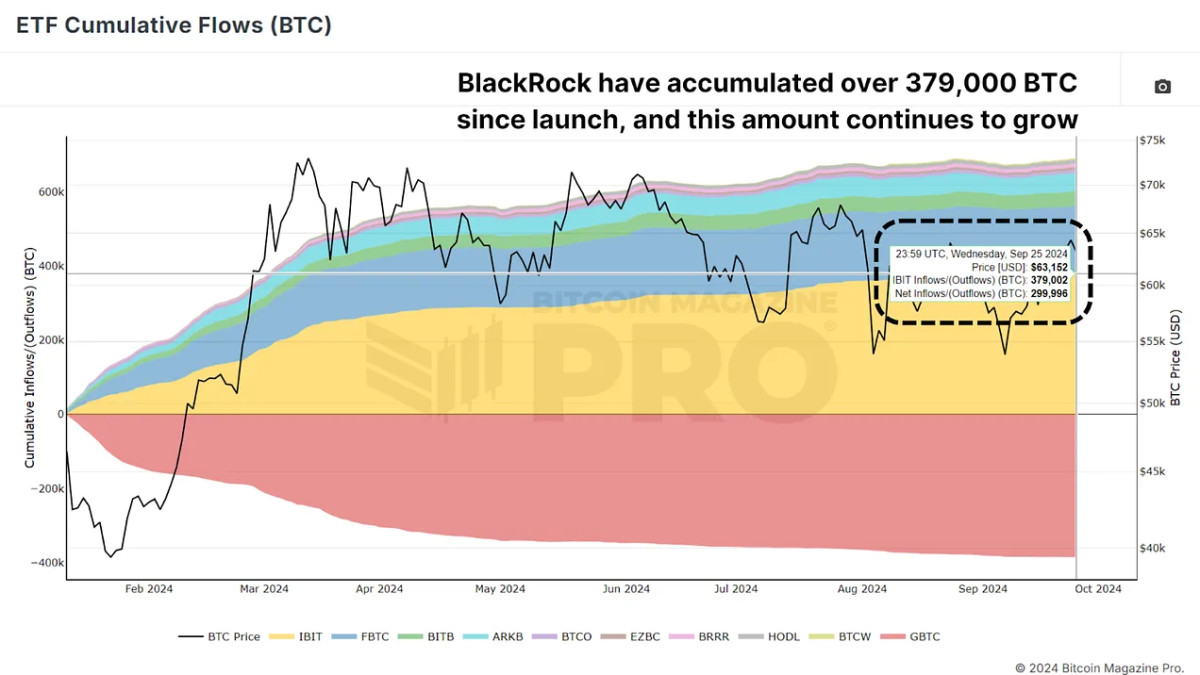

Bitcoin ETFs, introduced in January 2024, have temporarily gathered broad quantities of Bitcoin. Those ETFs, tracked by means of numerous price range, permit institutional and retail buyers to realize publicity to Bitcoin with out without delay proudly owning it. Those ETFs have accumulated billions of USD worth of BTC, and monitoring this cumulative current is very important for tracking institutional process in Bitcoin markets, serving to us gauge whether or not institutional gamers are purchasing or promoting.

ETF daily inflows denominated in BTC point out that large-scale buyers are amassing Bitcoin, era day-to-day outflows counsel they’re exiting positions all over that buying and selling length. For the ones taking a look to outperform Bitcoin’s already robust 2024 efficiency, this ETF information offer a strategic access and progress level for Bitcoin trades.

A Easy Technique In accordance with ETF Knowledge

The tactic is moderately simple: purchase Bitcoin when ETF inflows are certain (inexperienced bars) and promote when outflows happen (purple bars). Unusually, this mode lets you outperform even all over Bitcoin’s bullish classes.

This technique, era easy, has persistently outperformed the wider Bitcoin marketplace by means of taking pictures value momentum on the proper moments and keeping off attainable downturns by means of following institutional tendencies.

The Energy of Compounding

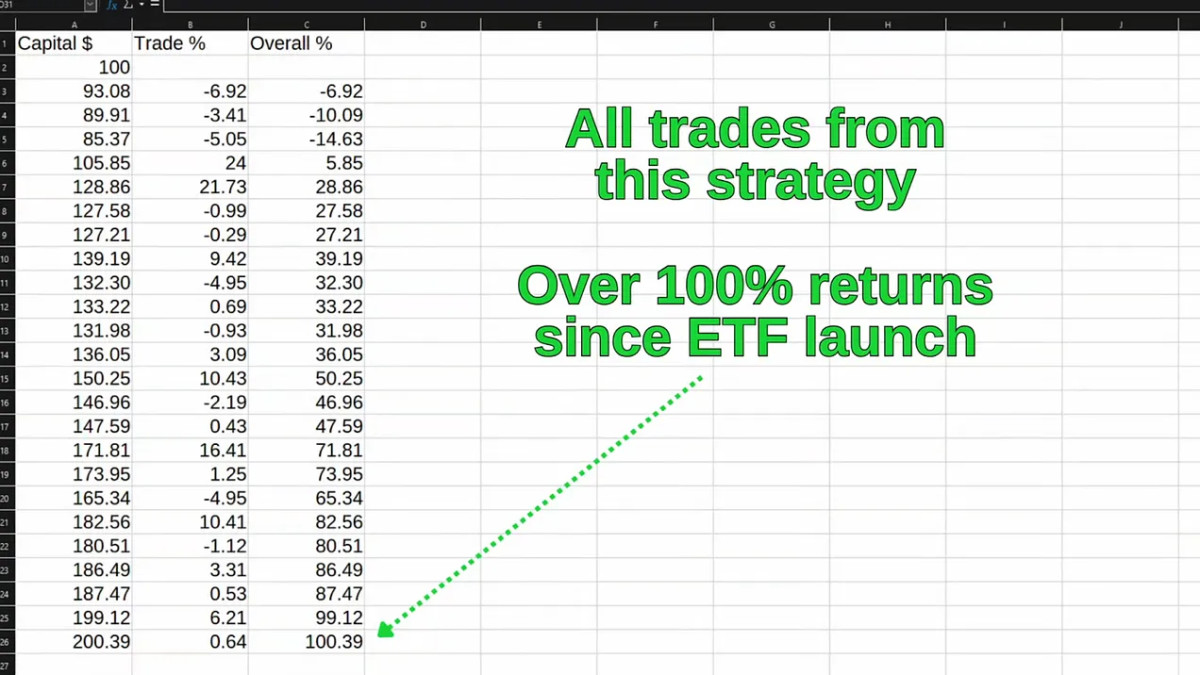

The actual unrevealed to this technique lies in compounding. Compounding beneficial properties over presen considerably boosts your returns, even all over classes of consolidation or minor volatility. Consider forming with $100 in capital. In case your first industry handovers a ten% go back, you presently have $110. At the later industry, some other 10% acquire on $110 brings your general to $121. Compounding those beneficial properties over presen, even little wins, acquire into important earnings. Losses are inevitable, however compounding wins a ways outweigh the occasional dip.

For the reason that foundation of the Bitcoin ETFs, this technique has supplied over 100% returns all over a length through which simply preserving BTC has returned more or less 37%, and even when compared to shopping for Bitcoin at the ETF foundation presen and promoting on the actual all-time top, which might have returned roughly 59%.

Can Additional Upside Be Anticipated?

Just lately, we’ve begun to peer a sustained trend of positive ETF inflows, suggesting that establishments are as soon as once more closely amassing Bitcoin. Since September nineteenth, each and every presen has observable certain inflows, which, as we will see, have steadily preceded value rallies. BlackRock and their IBIT ETF lonely have accrued over 379,000 BTC since inception.

Conclusion

Marketplace situations can alternate, and there’ll inevitably be classes of volatility. Then again, the constant historic correlation between ETF inflows and Bitcoin value will increase makes this a reliable software for the ones taking a look to maximise their Bitcoin beneficial properties. If you happen to’re on the lookout for a low-effort, set-it-and-forget-it way, buy-and-hold might nonetheless be appropriate. Then again, if you wish to attempt and actively building up your returns by means of leveraging institutional information, monitoring Bitcoin ETF inflows and outflows is usually a game-changer.

For a better glance into this matter, take a look at a up to date YouTube video right here: Using ETF Data to Outperform Bitcoin [Must Watch]